No relevant search results found.

Call us

Customer

Service

You are our greatest asset. Our commitment to serve and help you enables us to perform harder and stay one step ahead to provide best in class customer service. Our host of digital options ensure we stay connected to you anytime, anywhere

Our Promise

Consumer Obsession is a way of life and doing business for us.

We want to enable dreams and inspire healthier and happier lives.

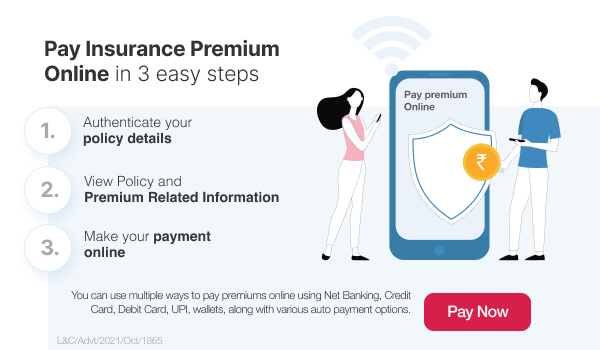

Pay Premium

Access Other Premium Payment Options

Policy Servicing

Find all information related to our processes, view all documentation required and raise a service request . Make changes to your personal or policy details, download statements / forms, and / or raise a Service Request (SR) quickly. For detailed information on your policy, login to your “My DigiAccount”

Fund Performance

How is my fund performing?

View Fact SheetClaim with Ease

Your claim is our priority, which is why our claim process is easy, transparent and consistent. Let our thoroughly trained professionals guide you for a hassle-free experience.

72 Lakh+

Families protected so far^

99.01%

Individual Death Claim Settlement Ratio for FY 22-23*

400+ Branches

Presence across major cities in India

73,500+ Crores

worth of Assets Under Management (AUM)~

Frequently

Asked Questions

There are two different modes of claim payment. These include:

- NEFT (National Electronic Fund Transfer)

- Cheque

Since no single policy can adequately cover all insurance objectives, it is recommended to acquire a portfolio of policies covering your various requirements. Your financial advisor can guide you in understanding what areas you would require cover for. If you do not have a financial advisor, reach out to us for help in choosing the right policies for your requirements.

A beneficiary is a person(s) or entity(ies) nominated in the policy as the recipient of the sum assured by a policy. This sum is received after the admittance of a claim or at the end of a policy term.

You can choose any of the following channels to reach out to us and raise a claim.

Email us at: customercare@tataaia.com

Call our helpline number - 1860-266-9966 (local charges apply)

Walk into any of the TALIC branch offices

Write directly to us at:

The Claims Department,

Tata AIA Life Insurance Company Limited

B- wing, 9th Floor,

I-Think Techno Campus,

Behind TCS, Pokhran Road No.2,

Close to Eastern Express Highway,

Thane(West) ֠400 607.

IRDA Regn No. 110

The duly filled & signed pre-authorization form, along with photo ID proof & cashless card need to be faxed from the hospital to TPA. The cashless transfer will be approved and initiated by TPA towards the hospital, on the basis of policy provisions.

Please visit the ‘Claims’ section of our website www.tataaia.com. You will find all the information you require about the claims process. You will also find the appropriate claim form for your policy and type of claim.

Non-disclosure occurs when a relevant fact is not mentioned while applying for or renewing an insurance contract. Such a fact may be important for the company to assess the risk. At the claims stage, if it is detected/found that the statements made at the time of application for reinstatement of the policy were false, the company has the right not to pay the claim amount.

Write to us

You can write your message below and we will revert to you.

Success

Disclaimers

^72,34,092 families protected till 31st March 2023.

*Individual Death Claim Settlement Ratio is 99.01% for FY 2022 - 23 as per the latest annual audited figures.

~As on 30th April 2023, the company has a total Assets Under Management (AUM) of Rs. 73,538.61 Crores

FOR EXISTING POLICY

FOR EXISTING POLICY

FOR NEW POLICY

FOR NEW POLICY