A Beginner's Guide to Financial Planning

2-June-2021 |

Financial planning is one of the most important economic practices that everyone must incorporate. It will organize your money from inception, serve your financial obligations and secure your family. An effective savings plan is the ideal way to start and make your financial plan better for a long-term journey. However, what are the key aspects to consider while managing money? What are the avenues of secure financial planning? How do you find which track is the best to invest money in? Follow these simple steps in financial planning to learn and save better.

- Start monitoring your expenses – The first and foremost step towards financial planning is to start finding your essential expenses and regulating them. Individuals have the habit of purchasing essentials at the very start of the month as soon as the salary arrives. The expenses increase, and by the end of the month, the crisis starts appearing. People may then borrow funds from friends and family members to manage for the last few days, thus creating a state of financial interdependence. Start monitoring your expenses right from the beginning. Decide on what is required and how to afford it wisely.

- Be aware of Non - Essential Expenses – The second step in Financial Planning is to be aware about certain expenses which are not planned and primarily involves entertainment, outside food, online shopping, etc. may takeaway good portion of your wallet. If you do not keep an eye on these expenses, then at the month end you would be wondering, where did you spend all the money and even though you had good account balance at the month beginning, then why there is financial crisis at the month end?

- Plan a budget – When there is clarity on the essential and non-essential expenses, you can start preparing a budget. Account for all the income sources and list all the expenses. Make the appropriate calculations and understand if your income could manage your expenses. If there is a discrepancy, ensure to alter the expenses. You must let a portion of your income free from expenses to plan for a secure future. Follow this simple Rule: Expenses = Income – Saving, that is save first and then plan for your expenses. Try to incorporate this savings idea from the beginning to make way for financial independence and effective wealth management throughout your life.

- Find out long term financial planning requirements – As a portion is getting reserved for the savings plan and the daily expenses are satisfied best, you can think of the long-term financial goals. For example, it can start from your higher education, marriage, purchasing a car and home, children education, their marriage and so on.

- Create Emergency Reserve – it is very important to create emergency reserve for yourself and your family. Life is uncertain and may throw many challenges like recent COVID 19 influenced lockdown which has impacted livelihood of many individuals. One can lose livelihood due to various reasons other than death, disability or disease. It is always advisable to keep 12 times of your monthly income as emergency reserve to meet any of such eventualities.

- Account for economic factors – The essential part of financial planning is to account for the long-term objectives considering the economic factors. This is because inflation can increase the cost of living and change the expenses towards a long-term goal. The cost of buying a car need not be the same after five years. Therefore, at every stage in life, calculate the expenses while keeping these factors in mind.

- Find ways for debt management - Everything you aspire cannot be bought under the purview of your salary. There will be a quantum of debt you will have to manage. Take a disciplined route towards essential loans. While deciding on the loans, calculate if your salary increase can afford it during the repayment tenure.

- Create a savings insurance plan -

A savings plan is an ultimate necessity. If an organized expenses management and budget can satisfy the current life, a surplus amount should be reserved for the future. Now that you know the extent of money required for your long-term expenses [considering inflation] and the debt coverage, you can derive how much money will be required for your future. You should ensure the following three aspects while considering your savings plan.

- You can provide financial protection to your family by covering your life and satisfying their needs even after your unexpected demise.

- You have considered current value/cost of long-term goal and accordingly apportioned money for those goals.

- You are able to manage daily expenses and other utilities every month even after you retire.

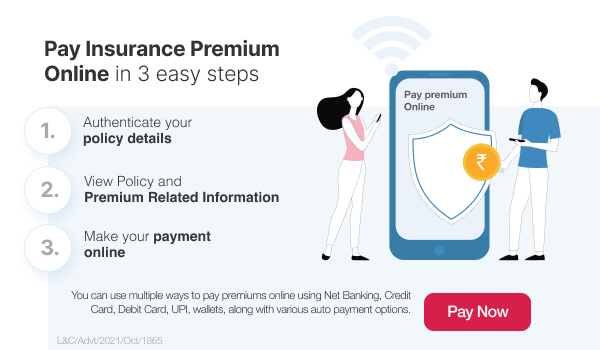

In order to satisfy the aspects mentioned above in the best possible manner, a whole life insurance savings plan will be a perfect choice. For such a plan, you will have to start paying a premium amount regularly. You will be provided with a life cover, and sum assured. Additionally, you will get guaranteed annual income after the policy's maturity till the income period you opted for. It can be till you survive or even after that. You can also enhance the plan with riders1 and extend the benefits coverage like any other life insurance policy.

Check out Tata AIA Life Insurance savings solutions to find the right savings plan for your specific financial goals and requirements.

- Start Early – In order to achieve maximum financial independence with minimum investment, one should start saving as early as possible so that power of interest compounding can beat the rising cost or inflation. Example: if you want to save 50 Lakh for retirement at age 55, then if you start at age 25, you need to save just Rs. 40,868 Per annum @8% interest rate as compared to Rs. 101,168 Per annum @8% if you start at age 35 or you need to save Rs. 3,19,581 Per annum @8%, if you start at age 45

S.No.

Starting Age

Retirement Age

Goal

Interest Rate

Saving Required

Total Money Invested

1

25

55

₹ 50,00,000

8%

₹ 40,868

₹ 12,26,032

2

35

55

₹ 50,00,000

8%

₹ 1,01,168

₹ 20,23,353

3

45

55

₹ 50,00,000

8%

₹ 3,19,581

₹ 31,95,810

- Create a diversified investment portfolio – You can further enrich your

financial planning with a good investment strategy. With options like unit-linked insurance plan, you can pay a portion for life cover and another portion for investing in equity, debt or hybrid funds. The returns are market-linked and contribute towards long term benefits surpassing the risk.

- Tax management – According to the Income Tax Act, 1961, you can avail of tax* benefits such as deductions and exemptions corresponding to your chosen Insurance savings plan. The premium amount paid, and the returns payable qualify for tax benefits. Read the sections under the law carefully and make the best use of a savings plan to reduce your taxable income.

- Plan for retirement corpus – Apart from planning for your regular expenses, building a corpus for your retirement purposes is equally important. It will suffice for any debt repayment, medical expenses, financial obligations like children marriage and other unexpected expenditures that would arise later on in life.

- Estate Planning – As a general practice, it is important that you list down your assets and how it has to be managed or disposed of in the event of your demise or a terminal illness leaving you incapacitated.

Conclusion

Financial independence at retirement should be the ultimate goal. A financial crisis should never be a cause for concern. An effective savings plan with adequate life coverage can help you serve your financial commitments in the best possible manner. There are various options to help you understand your goals, start early, plan for your savings and ensure your family's financial protection. Set the best practice and ensure you follow it!

L&C/Advt/2021/Jun/0733

FOR EXISTING POLICY

FOR EXISTING POLICY

FOR NEW POLICY

FOR NEW POLICY