19-07-2022 |

The renewability of a term insurance policy is an important feature. It will help you ascertain the life cover benefit for your family in case of your unexpected death during the policy tenure and over the extended term. Therefore, understanding what it means and its applicability to the different types of term life insurance plans will help you benefit maximally. Here is a detail about it for your understanding.

What is the Renewability Feature of the Term Insurance Policy?

A renewable term insurance policy is a life insurance term plan that allows extending the policy term without getting into the process of re-qualifying to purchase a new policy.

A term insurance policy provides the death benefit to your nominee in case of your unexpected death during the policy term. However, if you survive the policy tenure, you might have to purchase a new term insurance policy to ascertain the financial benefits later for your family. You might have to repeatedly go through the purchase procedure and pay a higher premium rate. Renewable term life insurance is beneficial in this regard.

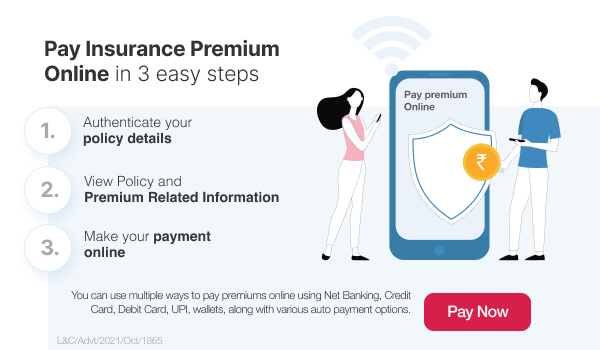

When you purchase the offline or the online term insurance with the renewable benefit, you can extend the policy term for the life cover without going through the regular policy purchase procedure. It is almost quick and instant to extend the policy tenure.

Applicability of the Renewable Benefit

There are different types of term life insurance policies. All of them are renewable, subject to the policy features and the insurance provider's terms and conditions.

Level term insurance - Level term insurance is a type of term insurance policy where the premium rate remains consistent. It does not increase with time and age. However, if it is purchased as a renewable term insurance policy, the premium might increase slightly during renewal.

Increasing term insurance - It is a term insurance policy where the sum assured keeps increasing based on your requirements. For example, when you purchase the Tata AIA term insurance policy, you can increase the sum assured at different milestones in your life. It is an ideal term insurance policy for people with increasing family commitments. When purchased as a renewable term plan, you can increase the policy term without any new procedures based on the policy conditions.

Decreasing term insurance - It is a term life insurance policy with which you can decrease the sum assured based on the family conditions. For example, if your children or close relatives are prepared to handle your financial responsibilities, you can reduce the life cover accordingly. It will reduce your premium while also ensuring a considerable lump-sum death benefit.

Renewable Term Life Insurance Advantages

Renewable term insurance plans are beneficial considering their advantages. Here is a detail about it.

Flexibility - With a yearly renewable term insurance plan, you can decide whether you need to extend the policy tenure or not based on the changing family commitments. For example, you might decide to retire at the age of 50 and might have purchased a term plan until then. However, with an increase in family financial goals, you might decide to retire a little later. In such scenarios, the annually renewable term insurance policy becomes highly beneficial.

Cost-effective - Compared to purchasing a term insurance policy exclusively new at a later age, the renewable online term plan is highly cost-effective.

Effortless procedures - Your insurance providers might ask you to undergo medical examinations before purchasing a term insurance plan based on the policy terms and conditions. When you renew the term insurance plan, you need not undergo the same medical examinations at the end of the policy tenure. The procedure becomes simple, easy and effortless.

How is Renewable Term Plans Different from Convertible Term Plans?

Many times, convertible term plans are confused with renewable term plans.

A renewable term insurance plan can extend the existing coverage at the end of the policy term. And a convertible term plan can convert the policy to a different term plan option within the policy tenure. For example, you can convert a convertible term insurance policy to a whole life term insurance plan. However, you cannot change a renewable term insurance plan to a whole life term insurance plan.

Who Can Purchase the Renewable Term Insurance Plans?

Renewable term insurance plans are suitable for the following categories of people:

People with a huge dependent family are unsure about their future financial commitments.

Sole earning members of a family.

Self-employed individuals, business professionals, etc., may not have a steady flow of income.

While purchasing the online term plan, renewal becomes simple and easy. There are very few steps that you need to follow. You can take the help of the customer service executive team in case of any queries related to the process and the status.

Conclusion

A term insurance policy will provide the death benefit to your nominee in case of your unexpected demise during the policy term. However, if you survive the policy term and want to extend the policy coverage for a certain period, you can always do so by purchasing a renewable term insurance plan. All the different types of term insurance plans, such as the level, increasing and decreasing term plans, will be applicable for the renewable benefit based on the policy terms and conditions. Therefore, while purchasing the term plan, read through the policy documents and ensure the applicability of the renewable feature to ascertain the necessary financial benefits!

L&C/Advt/2022/Jul/1570

FOR EXISTING POLICY

FOR EXISTING POLICY

FOR NEW POLICY

FOR NEW POLICY