Single/Unmarried Persons

No relevant search results found.

Call us

Calculate your Term Insurance Premium with our Online Premium Calculator

A Non-Linked Non-Participating Individual Life Insurance Plan (UIN:110N160V03)

Why choose Tata AIA Life Insurance Term Plans?

-

4 Hours

Express Claim Settlement**

-

Up to 46,800

Tax Savings++

-

The Tata AIA Assurance

Claim settlement ratio of 98.53%1

-

Whole Life coverage

Coverage up to age 100^

-

Rs 3,00,000 Crores+

Among the highest retail sum assured2

-

400+

Branches across India

-

68 Lakh+

Families protected so far3

-

Rs. 62,894 Crores

Assets Under Management (AUM)7

-

Payment Convenience

Choose premium payment mode as per convenience

Looking to buy a new insurance plan?

Our experts are happy to help you!

Success

Table of Content

-

Key Benefits of our Online Term Insurance Plans

-

Popular Tata AIA Life Insurance Online Term Plans

-

What are the 5 Reasons to Buy a Term Insurance Plan Online?

-

Your Claim Settlement is our Priority

-

How to Buy Term Insurance with Tata AIA Life Insurance?

-

How to Find the Right Term Insurance Plan Online?

Key Benefits of our Online Term Insurance Plans

Get Protection Up to 100 years

Get Protection Up to 100 years

Get life insurance coverage for up to 100 years^ and keep your family secure for a longer period of time. A longer life cover ensures that you do not have to worry about their financial future in case of an unfortunate eventuality.

Increase coverage at Important Milestones

Increase coverage at Important Milestones

With the Life Stage^ option, you can increase your coverage during important milestones such as marriage, childbirth, and home loan , so your life cover can keep up with growing financial responsibilities.

Optional Riders

Optional Riders

With optional riders## to cover you against hospitalization costs, cancer, heart ailments, critical illnesses, and to offer income replacement, waiver of premium benefits, and more, you can enhance your life insurance policy.

Flexible Choice of Plans

Flexible Choice of Plans

Choose from various term insurance online plan options with features and benefits as per your needs. Then, choose the sum assured based on your requirements and within your budget so that you can protect your family for years to come.

Tax Benefits

Tax Benefits

Claim tax4 deductions under Section 80C of the Income Tax Act on premiums paid on your term insurance policy and benefit from tax exemption under Section 10(10D) on the death benefit sum assured paid out to your beneficiaries. Save tax up to 46,800++.

Inbuilt Payor Accelerator

Inbuilt Payor Accelerator

The Inbuilt Payor Accelerator+++ benefit keeps your family secure in the event of a terminal illness where the medical costs can ruin your savings. Get 50% of the basic/effective sum assured on the diagnosis of a terminal illness with this feature.

Choice of Premium Payment Term and Policy Term

Choice of Premium Payment Term and Policy Term

Choose a flexible premium payment term and policy term for your term insurance plan to ensure timely premium payments. Your choice of policy term lets you choose for how long you want to keep your loved ones secure.

Lower Premiums for Women

Lower Premiums for Women

As a woman policyholder of an online term insurance policy, you can enjoy special premium rates. With preferential premium rates, you can pay lower premiums towards your term plan.

Popular Tata AIA Life Insurance Online Term Plans

Tata AIA Life Insurance Sampoorna Raksha Supreme (UIN: 110N160V03)

A Non-Linked Non-Participating Individual Life Insurance Plan (UIN: 110N160V03)

Key Features

- A comprehensive plan that gives your premiums back5

- Increase life cover at important milestones

- Get financial protection till 100 years^ of your age.

- Save Income Tax up to 46,800++

- Enhance your protection with optional riders##

InstaProtect Solution

Key Features

- Get Criticare Plus and Hospicare Benefit6

- Express@ Issuance

- Affordable premiums

- Avail Tax4 Benefits

What are the 5 Reasons to Buy a Term Insurance Plan Online?

-

Term Plans are Affordable

Purchasing a term insurance plan online can be quite affordable and cost-effective since you can calculate the term insurance premiums with an online term insurance premium calculator before you buy a term insurance plan online. Moreover, there are no overhead costs online.

-

Reliable and Transparent

All the information related to your online term insurance policy you need is available on your insurance provider’s website. You can read about the features, term plan benefits, and offerings of various term plans online. Moreover, you can download the policy brochure and also calculate your term insurance premiums online.

-

They are Customisable

There are a variety of online term insurance policies as you can choose the policy term, premium, and sum assured as per your needs. And if you need to enhance your plan’s coverage further, you can opt for one or more optional riders for an extra premium and protect yourself against financial emergencies.

-

Secure Online Payment

Not only are there multiple quick and convenient online premium payment options when you buy a term insurance plan online, but you can be sure that your insurance provider protects your personal and financial information by partnering with trusted payment gateways and platforms for your safety.

Your Claim Settlement is our Priority

When you file a claim with us, we understand how important it is to you and your family. Our skilled team reviews your claim and walks you through the process of settling it smoothly.

-

Doorstep claim services

Our Easy Claim Initiative brings you quick claim services right to your door. The Beneficiary can make an appointment by calling our helpline. Our agent will come to your home and assist you in filling out the paperwork and initiating the claim procedure as quickly as possible.

-

4 hour claim settlement

In addition, with our Express Claims service, a one-of-a-kind service initiative, the Beneficiary can submit the required documents to our agent, who will begin the claim procedure and ensure that the claim amount is paid within 4 hours**.

Who is Most Likely to Buy Term Insurance?

-

As a single individual, you may have certain liabilities and responsibilities to fulfil, for which you will need to have a term insurance policy. However, at this stage, even if you choose a higher cover, you can avail of low premiums probably because of lower risks and younger age than if you are an older individual.

Single/Unmarried Persons

As a single individual, you may have certain liabilities and responsibilities to fulfil, for which you will need to have a term insurance policy. However, at this stage, even if you choose a higher cover, you can avail of low premiums probably because of lower risks and younger age than if you are an older individual. -

Married Couples

Newly married couples have a bundle of new responsibilities in purchasing or setting up a new home. Additionally, instead of having an individual term insurance policy, they can now opt for a joint life term insurance plan to ensure the financial security of their spouse in their absence.Married Couples

Newly married couples have a bundle of new responsibilities in purchasing or setting up a new home. Additionally, instead of having an individual term insurance policy, they can now opt for a joint life term insurance plan to ensure the financial security of their spouse in their absence. -

New Parents

Parents who are either preparing for the birth of a child or raising young children need to be covered by a term insurance plan. With so many financial responsibilities, they should not only secure their spouse’s future but also that of their kids so that the latter do not have to compromise on their quality of life.New Parents

Parents who are either preparing for the birth of a child or raising young children need to be covered by a term insurance plan. With so many financial responsibilities, they should not only secure their spouse’s future but also that of their kids so that the latter do not have to compromise on their quality of life. -

Business owners

Businesses, especially new ones, come with loans, debts, and a lot of risks. But savings your family from their impact should be a priority. As a business owner, a term policy for an entrepreneur can help repay outstanding debts and loans in case of an unfortunate event so that your family does not have to spend their savings.Business owners

Businesses, especially new ones, come with loans, debts, and a lot of risks. But savings your family from their impact should be a priority. As a business owner, a term policy for an entrepreneur can help repay outstanding debts and loans in case of an unfortunate event so that your family does not have to spend their savings.

What are the Payout Options in Term Life Insurance?

When you have a term insurance plan, your family will be secure with the benefits paid out through the policy in case of your demise before the policy term ends. Hence, when purchasing the policy, you will have to name your beneficiaries. It could be your parent, partner, sibling, child, or any other close relative who you can trust. These are the term life insurance payout options that you can choose:

-

Lump-Sum Payout

The entire death benefit sum assured from the term insurance policy will be paid out to your nominee in case of your demise within the policy term. The nominee can decide how the benefits can be utilised further.

-

Monthly Income

By selecting this option, you can ensure an equal amount of money is paid out each month from the death benefit to your nominee. These regular payments can help in managing small financial commitments as also major ones.

-

Lump-Sum and Income

If you select this payout option, your beneficiaries will receive the death benefit partly as a lump sum, and the rest of it will be paid out as monthly income. This can be beneficial if your family has varied financial commitments and goals.

-

Income for Fixed Period

Many term plans pay the sum assured for a fixed income period. Under this option, the income period is either fixed or needs to be selected so your nominee can get the benefits for the specified number of years.

Looking to buy a new insurance plan?

Our experts are happy to help you!

Success

People Like You Also Read

Frequently Asked Questions About Buy Term Insurance Online

How to buy term insurance with Tata AIA life insurance?

When you buy a term insurance plan online, you can save a lot of time, money and effort by avoiding unnecessary fees, lengthy forms or undergoing complicated processes to get your term insurance quotes. Purchasing an online term insurance plan with Tata AIA Life Insurance is a simple process that can be done from the comfort of your home and in a few simple steps:

- Visit the official website of Tata AIA Life Insurance and click on Buy Term Plan.

- Fill out the online form on the right-hand side of the page with your name, email ID and mobile number.

- You can now choose your desired sum assured as per your needs and budget. By using our online term plan calculator, you can finalise your sum assured.

- At this step, you can compare your plan options to examine the features, offerings and term plan benefits.

- Add your choice of optional riders## to your term insurance plan and then finalise the quote as per your preference.

- Once you select the plan, make the premium payment by selecting any of the convenient online payment channels.

How to find the right term insurance plan online?

Term insurance plans are convenient because they offer a high sum assured at very affordable premiums. The aim of term plans is to provide complete financial security to you and your family members in case of an unfortunate event that leads to your demise. Therefore, carefully evaluate all factors such as your age, health, liabilities, expenses, your family’s current and future expenses, your income, etc., before you buy a term insurance plan online. Here are some of the major factors that can help you find the right term insurance plan online:

- Claim Settlement Ratio

Your insurer’s claim settlement ratio matters the most because it indicates if they can settle your death claim in full as per the plan benefits and offer the term life insurance payout to your nominee, as predetermined at the time of the policy purchase.

- Solvency Ratio

The solvency ratio is yet another important factor because it is a direct indicator of your insurer’s financial health. It informs you if the insurer can settle your claims and meet its liabilities with its current cash flow. The solvency ratio, like the claim settlement ratio, also needs to meet certain standards so that you can gauge their capacity to settle your claims.

- Choice of Riders

If you are purchasing a term insurance plan, be sure that you also take a look at the insurance provider’s range of optional riders##. Some of the most crucial ones, such as a critical illness cover and a waiver of premium cover, must be present in their offerings. Apart from that, if there are other health riders and protection riders, understand the features and go ahead with the term plan purchase.

When you buy a term insurance plan online, it is easy to find all the information you need about your insurance provider once you are aware of what you need to look out for.

How does the online term plan work?

An online term plan can be purchased from the official website of your insurance provider and is designed to offer pure life insurance coverage to your family members. Below are the steps that describe the working of an online term plan.

An online term plan comprises a life insurance cover that protects your family. In the event of your demise during the policy term selected by you at the time of purchase, the death benefit sum assured, predetermined by you, will be paid out to your beneficiaries.

You can add an optional rider## to your term insurance plan to enhance the policy coverage and be protected against medical emergencies such as critical illnesses, accidental death and disabilities, and more.

The death benefits are paid out after a claim is filed by your selected nominee and the claim is approved. The benefits under the Tata AIA Life Insurance term plan can be paid out either as a lump sum or as an income for up to 60 months.

In the case of a pure term plan, no survival benefits are payable if you outlive the policy term. However, in the case of a return of premium term plan, the maturity benefit will be a paid on the policy. With Tata AIA Life Insurance Sampoorna Raksha Supreme (UIN:110N160V03), the policy holder can get up to 105% of the premium5 back.

Is it safe to buy term insurance plan online?

While purchasing an online term insurance plan, the safety of buying an online policy always concerns us. This concern is valid since a lot of fraudulent websites may try to sell you term insurance policies. To ensure that you buy a term insurance plan online in a safe and secure manner, here are some points to remember:

- Be sure to buy a term insurance plan online from a reputed life insurance provider.

- Only visit your insurance provider’s official website to purchase your term insurance plan.

- Do not entertain emails and messages from unidentified numbers that try to sell online term policies.

- Avoid offering your financial details to unknown people over the phone or email unless you confirm their identity.

- Do not mention any personal, contact or financial information if the website URL starts with “http”. Instead, the web address should start with “https”.

What is an online term insurance plan?

An online term insurance plan is a form of life insurance plan that you can choose, compare and purchase online through your insurance provider’s official website. An online term insurance policy provides the same benefits of life insurance coverage as an offline policy; however, purchasing it online can help you choose from more flexible options in terms of the policy tenure, premium payment frequency and modes and online premium payment options as well.

Additionally, you can use the online term insurance premium calculator to calculate your premiums and sum assured as per your needs and budget in a short span of time.

What term plan benefits can you enjoy when you buy a term policy online?

When you buy a term policy online, you can enjoy term plan benefits such as a swift online purchasing process and supportive customer service guidance at the time of policy purchase.

Once your term insurance policy is in effect, you and your family can enjoy comprehensive life insurance coverage and be financially secure in case of an unfortunate event.

How do I buy a Tata AIA term plan online?

- To buy a Tata AIA term plan online, please visit our official website and click on Buy Term Plan. Then fill up the online form on the page with your contact details and proceed with the next steps to choose your choice of term plan.

- Once that is done, you will be able to compare your term plan with other term plans or term plan options.

- Adjust the sum assured, the premium payment frequency and mode and the policy term to arrive at a suitable premium payment and a summary of the plan benefits.

- You can then proceed to select your choice of term plan and make an online payment through any of the convenient digital payment options.

Can I add a rider to my policy?

Yes, you can add a rider## to your term insurance policy at the time of policy inception. At Tata AIA, we have a range of rider benefits covering hospitalization, Critical Illness, Disability/Death due to accident etc to help make your protection plan as comprehensive as possible.

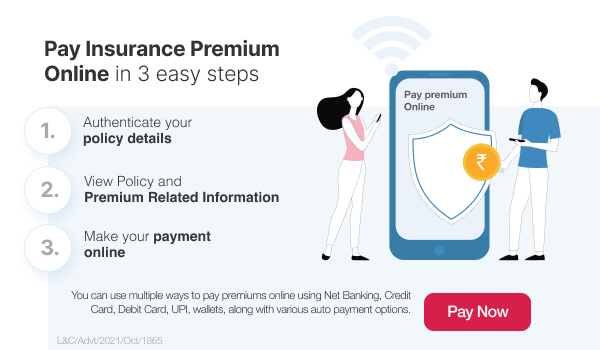

How do I make the online premium payment on my policy?

When you buy term insurance online, you will have the option to pay your first premium online in the premium payment mode and frequency of your choice on the official website of your insurance provider. Then, when you have to pay the upcoming premiums, you can simply choose from different premium payment options on the website after logging in with your contact details and policy number or select a premium auto-debit option at the time of policy purchase.

What happens if you discontinue your premium payments?

If you do not pay your premiums past the policy expiry date, Tata AIA Life Insurance will offer a grace period 30 days for online insurance plans. However, if you still do not pay the premium within this period, the policy will lapse, and your family will not be able to receive the benefits from the plan.

If I purchase term life insurance online, will it be more affordable than an offline term plan?

Yes, it will be more affordable to purchase term life insurance online from our official website. You can use an online term insurance premium calculator to view the premium amount for the policy tenure and plan selected.

Is the claim settlement ratio of term insurance important?

Yes, the claim settlement ratio of term insurance matters because it will help you understand if your insurance provider can settle your claims effectively and on time. Tata AIA Life Insurance has a claim settlement of 98.02%1. With our Express claim settlement promise, you claims can be settled within 4 hours**.

Do online term insurance policies come with a free-look period?

Yes, online term insurance policies come with a free-look period of 30 days.

Why is it safe to buy term insurance online?

It is safe to buy term insurance online because reputed insurance providers ensure complete online security on their official websites and their online payment channels. Moreover, your contact details and personal and financial information will not be stored on the website, and so when someone else logs into the same system, they will not be able to access your policy details.

What is the process for filing a claim for an online term insurance plan?

If you want to file a claim with us for an online term insurance plan, you can choose any of the options below –

- Register a Claim online on our website

- Send us an email at: customercare@tataaia.com

- Call our helpline number - 1860-266-9966 (local charges apply)

- Visit any of our Tata AIA Life Insurance Company branch offices

- Write to us at the below address:

The Claims Department,

Tata AIA Life Insurance Company Limited

B- Wing, 9th Floor,

I-Think Techno Campus,

Behind TCS, Pokhran Road No.2,

Close to Eastern Express Highway,

Thane (West) 400 607.

IRDA Regn. No. 110

When do I receive my term life insurance payout?

If you have purchased a pure term plan, then only the death benefits will be paid out to your nominee in the event of your death. If you survive the policy term, there will be no term life insurance payout. On the other hand, if you have a term insurance policy with a return of premium, not only will your family may receive the sum assured on in case of any unfortunate event such as demise of the policyholder, but you can also claim the survival benefits, which is the return of premiums on the policy maturity.

How do I choose the most suitable term insurance policy online?

Before you buy a term insurance policy online, be sure to consider your income, your family’s current financial needs, their future financial needs and also any medical emergencies that may occur in your absence.

The key to choosing the most suitable term insurance policy online is to compare different plans and plan options and the premiums so that you can choose the one with the needed coverage but at a premium rate that is affordable for you.

Disclaimers

All Premiums are subject to applicable taxes, cesses & levies which will be entirely borne/ paid by the Policyholder, in addition to the payment of such Premium. Tata AIA Life shall have the right to claim, deduct, adjust, recover the amount of any applicable tax or imposition, levied by any statutory or administrative body, from the benefits payable under the Policy. Kindly refer the sales illustration for the exact premium. Claims beyond three years from the date of issuance of policy or the date of commencement of risk or the date of revival of the policy or the date of the rider to the policy, whichever is later. Subject to all the relevant terms and conditions of the policy contract.

Claim Processing - All the relevant terms and conditions of the policy contract, including provisions in respect to claim procedure shall apply. Unit linked products; policies with unclaimed amounts or last premium payment not cleared are excluded.

**4 Hour claim processing is applicable for Tata AIA Life Insurance working days (Monday to Friday) up to 2 pm and also bank working days subject to submission of completed documents.

++Tax benefits of up to ₹46,800 u/s 80C is calculated at highest tax slab rate of 31.20% (including cess excluding surcharge) on life insurance premium paid of ₹1,50,000. Tax benefits under the policy are subject to conditions laid under Section 80C, 80D,10(10D), 115BAC and other applicable provisions of the Income Tax Act,1961. Good and Service tax and Cess, if any will be charged extra as per prevailing rates. The Tax-Free income is subject to conditions specified under section 10(10D) and other applicable provisions of the Income Tax Act,1961. Tax laws are subject to amendments made thereto from time to time. Please consult your tax advisor for details, before acting on above.

+++Inbuilt Payout Accelerator Benefit pays out 50% of Basic/Effective Sum Assured (as applicable) in case of a Terminal Illness diagnosis

##Riders are not mandatory and are available for a nominal extra cost. For more details on benefits, premiums and exclusions under the Rider, please contact Tata AIA Life's Insurance Advisor/Intermediary/ branch.

Tata AIA Life Insurance Non-Linked Comprehensive Protection Rider (UIN:110B033V02 or any other later version) and Tata AIA Life Insurance Non-Linked Comprehensive Health Rider (UIN: 110B031V02 or any other later version) are available under this plan.

Tata AIA Life Insurance InstaProtect comprises of Tata AIA Life Insurance Sampoorna Raksha Supreme (Non Linked, Non Participating, Individual Life Insurance Plan) (UIN: 110N160V03), Tata AIA Life Insurance Non-Linked Comprehensive Protection Rider (NLCPR) (UIN: 110B033V02) - A Non-linked, Non-participating, Individual Health Rider; Tata AIA Life Insurance Non-Linked Comprehensive Health Rider (NLCHR) (UIN: 110B031V02) - A Non-linked, Non-participating, Individual Health Rider.

^Applicable for specific plan options. Please refer brochure for additional details.

1Individual Life Claim Settlement Ratio is 98.53% for FY 2021 - 22 as per the latest annual audited figures.

2Retail Sum Assured for FY22 is Rs 3,07,804 Cr.

368,75,083 families protected till Oct’22.

7AUM (Shareholders and Policyholders Fund) stands at Rs. 62,894 Cr as on Aug’22.

4Income Tax benefits would be available as per the prevailing income tax laws, subject to fulfillment of conditions stipulated therein. Income Tax laws are subject to change from time to time. Tata AIA Life Insurance Company Ltd. does not assume responsibility on tax implication mentioned anywhere in this document. Please consult your own tax consultant to know the tax benefits available to you.

5Under Life Plus Option, an amount equal to the 105% of the Total Premiums Paid (excluding loading for modal premiums) shall be payable at the end of the Policy Term as Maturity Benefit, provided the life assured survives till maturity and the policy is not terminated earlier. Under Tata AIA Life Insurance Non-Linked Comprehensive Protection Rider (Term Benefit with accelerated Terminal Illness ROP option), an amount equal to the Total Premiums Paid towards the respective benefit option (excluding loading for modal premiums), less any claim amount already paid out under the respective benefit option, shall be payable at the end of the benefit option term, provided the benefit option is not terminated.

6Criticare Plus Benefit (CPB), Accidental Death benefit (ADB) and Accidental Total and Permanent Disability Benefit (ATPD) are benefit options available under Tata AIA Life Insurance Non-Linked Comprehensive Protection Rider and HospiCare Benefit (HCB) is available under Tata AIA Life Insurance Non-Linked Comprehensive Health Rider

@Express Issuance for standard lives. The solution will be underwritten by Tata AIA Life Insurance Company Limited. Additional Requirements may be called at underwriters’ discretion.

This product is underwritten by Tata AIA Life Insurance Company Ltd.

The plan is not a guaranteed issuance plan and it will be subject to company’s underwriting and acceptance.

Insurance cover is available under this product.

For more details on risk factors, terms and conditions please read sales brochure carefully before concluding a sale. The precise terms and condition of this plan are specified in the Policy Contract.

Buying a Life Insurance Policy is a long-term commitment. An early termination of the Policy usually involves high costs and the Surrender Value payable may be less than the all the Premiums Paid.

In case of non-standard lives and on submission of non-standard age proof, extra premiums will be charged as per our underwriting guidelines.

The solution will be underwritten by Tata AIA Life Insurance Company Limited. Additional Requirements may be called at underwriters discretion. Insurance cover is available under this solution. The solution is not a guaranteed issuance plan and it will be subject to company’s underwriting and acceptance. In case of sub-standard lives extra premiums will be charged as per our underwriting guidelines. For more details on the benefits, premiums and exclusions under the Base product and rider, please refer both Product and Rider brochure or contact our Insurance Advisor /Intermediary or visit our nearest branch office. Buying a life Insurance policy/rider is a long term commitment. An early termination of the policy/ benefit option under a rider usually involves high costs and the surrender value payable may be less than all the premiums paid.

L&C/Advt/2022/Oct/2602

FOR EXISTING POLICY

FOR EXISTING POLICY

FOR NEW POLICY

FOR NEW POLICY

.png)