THE LINKED INSURANCE PRODUCT DO NOT OFFER ANY LIQUIDITY DURING THE FIRST FIVE YEARS OF THE CONTRACT. THE POLICY HOLDER WILL NOT BE ABLE TO SURRENDER/WITHDRAW THE MONIES INVESTED IN LINKED INSURANCE PRODUCTS COMPLETELY OR PARTIALLY TILL THE END OF THE FIFTH YEAR.

This advertisement is designed for combination of benefits of following individual and separate products named (1) Tata AIA Smart Sampoorna Raksha Supreme Unit Linked, Non-Participating Individual Life Insurance Plan (UIN: 110L179V02) and (2) Tata AIA Vitality Protect Advance A Non-Linked, Non- Participating Individual Health Product (UIN: 110N178V01).

These products are also available for sale individually without the combination offered/ suggested. This benefit illustration is the arithmetic combination and chronological listing of combined benefits of individual products. The customer is advised to refer the detailed sales brochure of respective individual products mentioned herein before concluding sale.

Critical Illness, Accidental Death, Accidental Disability, Term Booster are available with Tata AIA Vitality Protect Advance (UIN: 110N178V01).

*Income Tax benefits would be available as per the prevailing income tax laws, subject to fulfilment of conditions stipulated therein. Income Tax laws are subject to change from time to time. Tata AIA Life Insurance Company Ltd. does not assume responsibility on tax implications mentioned anywhere on this site. Please consult your own tax consultant to know the tax benefits available to you.

+Tax benefits of up to ₹46,800 u/s 80C is calculated at highest tax slab rate of 31.20% (including cess excluding surcharge) on life insurance premium paid of ₹1,50,000. Tax benefits under the policy are subject to conditions laid under Section 80C, 80D,10(10D), 115BAC and other applicable provisions of the Income Tax Act,1961. Good and Service tax and Cess, if any will be charged extra as per prevailing rates. The Tax-Free income is subject to conditions specified under section 10(10D) and other applicable provisions of the Income Tax Act,1961. Tax laws are subject to amendments made thereto from time to time. Please consult your tax advisor for details, before acting on above.

$The premium paid in Unit Linked Life Insurance policies are subject to investment risks associated with capital markets and the NAVs of the units may go up or down based on the performance of fund and factors influencing the capital market and the insured is responsible for his/her decisions. The various funds offered under this contract are the names of the funds and do not in any way indicate the quality of these plans, their future prospects and returns. On survival to the end of the policy term, the Total Fund Value including Top-Up Premium Fund Value valued at applicable NAV on the date of Maturity will be paid.

++All funds open for new business which have completed 5 years since inception are rated 4 or 5 star by Morningstar~ as of Nov’24.

- ~@2024 Morningstar. All rights reserved. The Morningstar name is a registered trademark of Morningstar, Inc. in India and other jurisdictions. The information contained here: (1) includes the proprietary information of Morningstar, Inc. and its affiliates, including, without limitation, Morningstar India Private Limited (“Morningstar”); (2) may not be copied, redistributed or used, by any means, in whole or in part, without the prior, written consent of Morningstar; (3) is not warranted to be complete, accurate or timely; and (4) may be drawn from data published on various dates and procured from various sources and (5) shall not be construed as an offer to buy or sell any security or other investment vehicle. Neither Morningstar, Inc. nor any of its affiliates (including, without limitation, Morningstar) nor any of their officers, directors, employees, associates or agents shall be responsible or liable for any trading decisions, damages or other losses resulting directly or indirectly from the information.

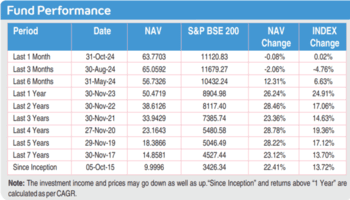

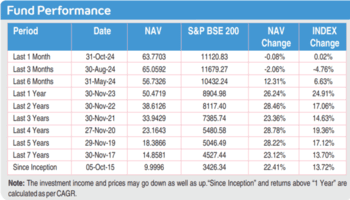

- #5-year computed NAV for Multi Cap Fund as of Nov’2024. Other funds are also available. Benchmark of this fund is S&P BSE 200

**Subject to a maximum term of 40 years

$$Tata AIA Vitality - A Wellness Program that offers you an upfront discount at policy inception. You can also earn premium discount / cover booster (as applicable) for subsequent years on policy anniversary basis your Vitality Status (tracked on Vitality app) (2) Please refer rider brochures for additional details on health and wellness benefits.

^^On enrolling into the wellness Program, you get an upfront discount of 5% on first year premium for Accidental Death, Accidental Total & Permanent Disability, and of 10% on first year premiums of Term Booster benefit option. The rewards are offered on cumulative basis and in any year, the maximum rewards in view of both the upfront rewards and annual rewards flex together shall be 15% for Accidental Death & Accidental Total & Permanent Disability and 30% for Term Booster benefit option. Discount is driven by accumulated points which is achieved through wellness status. Please refer policy document for more details.

Vitality is a trademark licensed to Tata AIA Life by Amplify Health Assets PTE. Limited, a joint venture between Vitality Group International, INC. and AIA Company Limited. The assessment under the wellness program shall not be considered as a medical advice or a substitute to a consultation/treatment by a professional medical practitioner.

^Individual Death Claim Settlement Ratio is 99.13% for FY 2023 - 24 as per the latest annual audited figures.

2Applicable to only non-early claims more than 3 years of policy duration, non-investigation cases, up to Sum assured of 50 Lakh. Applicable for branch walk in. Time limit to submit claim to Tata AIA by 2 pm (working days). Subject to submission of complete documents. Not applicable to ULIP policies and open title claims.

377,26,727 families protected till December ’23

4All Premiums in the policy are exclusive of applicable taxes, duties, surcharge, cesses or levies which will be entirely borne/ paid by the Policyholder, in addition to the payment of such Premium.

5Retail Sum Assured for FY2023 is Rs 4,43,479 Crores

6The Insured Amount under Term Booster option (in Vitality Protect Advance) is payable on earlier of death or diagnosis of Terminal illness of the Life Insured. Please refer Terms and Conditions for more details.

- 7On survival to the end of the policy term, the Total Fund Value including Top-Up Premium Fund Value valued at applicable NAV on the date of Maturity will be paid.

- Some benefits are guaranteed and some benefits are variable with returns based on the future performance of your insurer carrying on life insurance business. If your policy offers guaranteed benefits then these will be clearly marked “guaranteed’ in the illustration table on this pages. If your policy offer variable benefits then the illustrations on this pages will show two different rates of assumed future investment returns. Currently the gross investment returns are stipulated as 4% p.a. and 8% p.a. These assumed rate of return are not guaranteed and these are not the upper or lower limits of what you might get back, as the value of your policy is dependent on a number of factors including actual future investment performance.

These products are also available for sale individually without the combination offered/ suggested. This benefit illustration is the arithmetic combination and chronological listing of combined benefits of individual products. The customer is advised to refer the detailed sales brochure of respective individual products mentioned herein before concluding sale.

The fund is managed by Tata AIA Life Insurance Company Ltd. (hereinafter the “Company”). Tata AIA Life Insurance Company Limited is only the name of the Insurance Company & Tata AIA Smart Sampoorna Raksha Supreme is only the name of the Unit Linked Life Insurance contract and does not in any way indicate the quality of the contract, its future prospects or returns.

Past performance is not indicative of future performance. Returns are calculated on an absolute basis for a period of less than (or equal to) a year, with reinvestment of dividends (if any).

Returns are calculated on an absolute basis for a period of less than (or equal to) a year, with reinvestment of dividends (if any). Life insurance cover is available under the solution. For details on products, associated risk factors, terms and conditions please read Sales Brochure carefully before concluding a sale. The precise terms and condition of this plan are specified in the Policy Contract.

Tata AIA Life shall have the right to claim, deduct, adjust, recover the amount of any applicable tax or imposition, levied by any statutory or administrative body, from the benefits payable under the Policy. Kindly refer the sales illustration for the exact premium.

Insurance cover is available under this product. This product is underwritten by Tata AIA Life Insurance Company Limited. The plan is not a guaranteed issuance plan and it will be subject to Company’s underwriting and acceptance. This product will be offered to Standard lives only.

Investments are subject to market risks. The Company does not guarantee any assured returns. The investment income and price may go down as well as up depending on several factors influencing the market.

The performance of the managed portfolios and funds is not guaranteed, and the value may increase or decrease in accordance with the future experience of the managed portfolios and funds.

Please know the associated risks and the applicable charges, from your insurance agent or the Intermediary or policy document issued by the Insurance Company.

Whilst every care has been taken in the preparation of this content, it is subject to correction and markets may not perform in a similar fashion based on factors influencing the capital and debt markets; hence this advertisement does not individually confer any legal rights or duties. This is not an investment advice, please make your own independent decision after consulting your financial or other professional advisor.

L&C/Advt/2024/Oct/2990