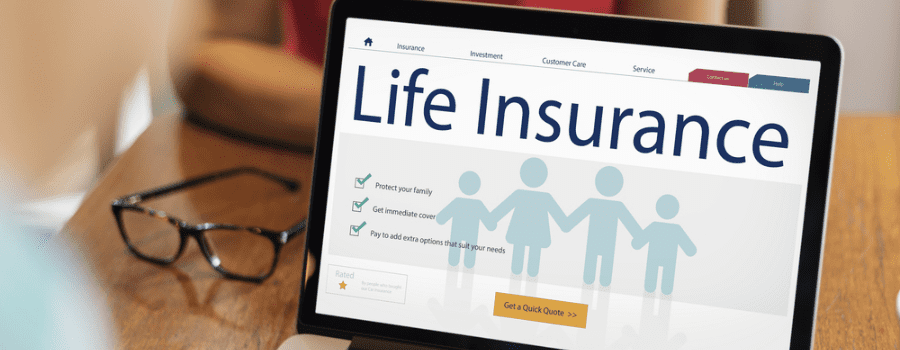

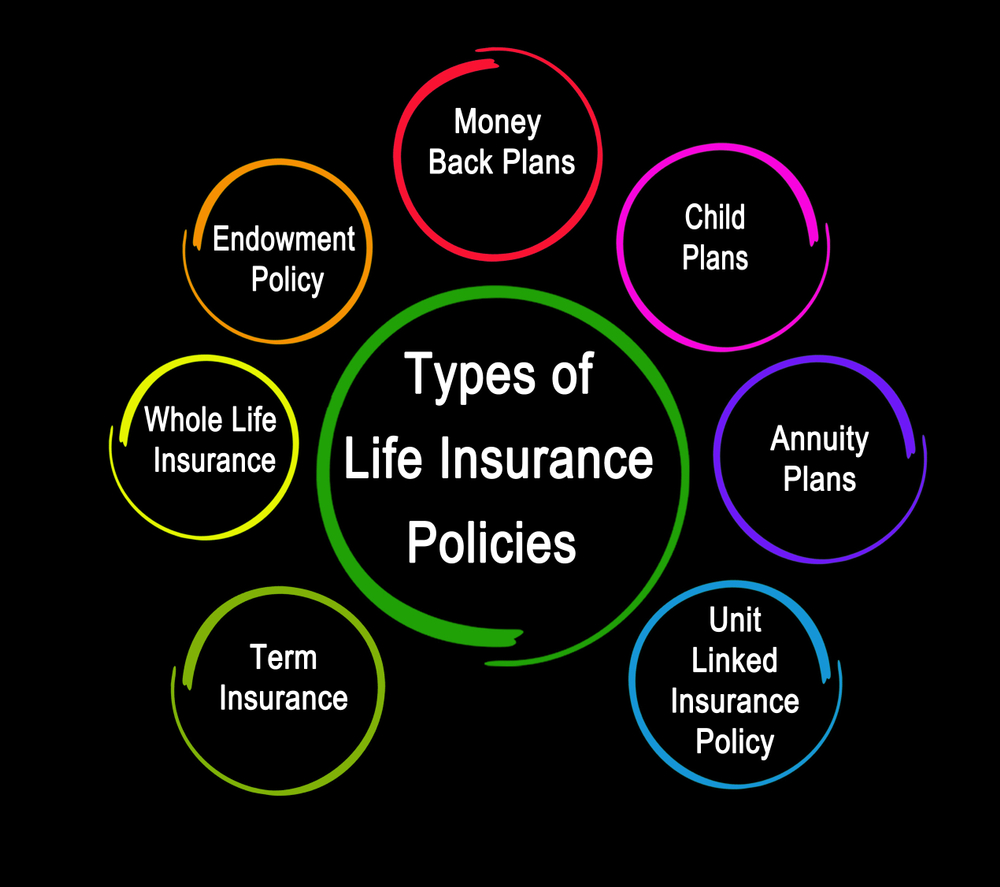

Life insurance is a legally binding contract between you (the policyholder) and a life insurance company that provides financial protection to your loved ones. In return for paying your premiums on time, the insurer promises to pay a pre-agreed amount, known as the sum assured or life cover, ... Read more to your nominee if you pass away during the policy term.

Many life insurance plans also offer benefits for critical or terminal illnesses, and you can add optional accident or disability cover for extra protection. To get accurate life insurance quotes, you must share your health and lifestyle details honestly and choose between a single premium or regular premiums. This helps you find the right life insurance plan to support your family’s long-term financial stability. Read less

FOR EXISTING POLICY

FOR EXISTING POLICY  1860 266 9966

1860 266 9966

FOR NEW POLICY

FOR NEW POLICY