Why should you buy a Term + Wealth plan?

Comprehensive Financial Protection

The term plan will protect your family against various financial risks in case of your untimely death during the policy term. And you will also get the opportunity to grow wealth for your family's future financial obligations.

Focus On Wealth Creation

While you can focus on growing your wealth, the insurance coverage available under these plans secures your family. Therefore, you can align your financial planning and investment decisions based on your requirements.

Offer Tailored Solutions

For a term plan with market-linked4 returns, you can choose from a range of fund options based on your risk appetite and financial goals. You can opt for debt-based funds for stability, equity-based funds for higher growth, and hybrid funds for a balanced approach.

Inflation Hedge

Market-linked4 investments will outpace inflation in the long term, preserving the purchasing power of your savings. By investing in equity-based funds, you can mitigate financial risks caused by inflation better and secure your future.

Benefits of a Term + Wealth plan

Affordability

You can get extensive term life insurance coverage and wealth creation opportunities at an affordable rate. In addition, if you invest at an early age and enjoy the benefit of lower multiples and lower life cover charges.

Flexibility

You can choose between the various flexible features, such as the premium payment option, premium payment frequency, cover term, and investment fund options, based on your financial condition and requirements.

Long-Term Investment

As term plans with market-linked4 returns allow for choosing a long policy term, you get the opportunity for systematic wealth accumulation. The longer you stay invested, the better the power of compounding and the higher the market-linked9 investment benefits.

Tax Advantage

Like any other life insurance policy, the premium paid, and the payouts received from the term plan with the market-linked4 returns will qualify for a tax2 deduction and exemption benefit under Section 80C and Section 10(10D) of the Income Tax Act 1961.

Who should buy a Term + Wealth plan?

A term plan with market-linked4 returns is suitable for any individual seeking a life insurance cover and market-linked4 investment opportunities. However, the following categories of people can consider purchasing it for certain specific reasons, as discussed below..

Young Professionals

Young professionals have distinct long-term financial goals ranging from purchasing a new car to starting a new business. They will have a high-risk tolerance for wealth creation and the advantage of lower premium rates.

Newly Married Couples

Newly married couples planning their future with children at different stages in life will have increasing financial commitments, such as their child's education, marriage, etc and a financial cushion to keep these financial goals safe. The cost of them keeps increasing with the inflation rate. A term plan with market-linked4 returns can suffice for such requirements with adequate planning.

For Parents

Parents can use the funds to fund their child’s education and the term plan provides the financial protection for dependents. The dual benefit ensures that parents can safeguard their family’s future while growing their wealth.

Individuals Planning Early Retirement

Most of us these days want to earn at a higher pace, secure and invest the earnings and want to retire early. A term plan with market-linked4 returns will help them invest for market linked returns, which can further be utilised for receiving a passive income for life after retirement.

Why choose Tata AIA Life Insurance?

Choice of Policies

You can choose from the different policy options as per your needs. Our policies offer flexibility in terms of policy coverage, policy terms, investment fund options, and premium payment options to make the selection more accessible for you.

Compare Policies

If you are deciding between the different plans, you can utilise the 'Calculate Premium' option specific to the options to determine the premium, compare, and make a well-informed decision. That way, you can compare the features, benefits, and premiums of the options before choosing one.

Seamless Online Process

When purchasing a new policy, Tata AIA Life Insurance offers a simple and swift online process for your convenience. You can also choose from multiple digital payment options for easy premium payments.

The Tata AIA Assurance

The claim settlement ratio denotes the number of claims honoured each year. With an individual death claim settlement ratio of 99.41%9 in the FY 2024-25, you can rely on us to settle your claims in a timely and efficient manner.

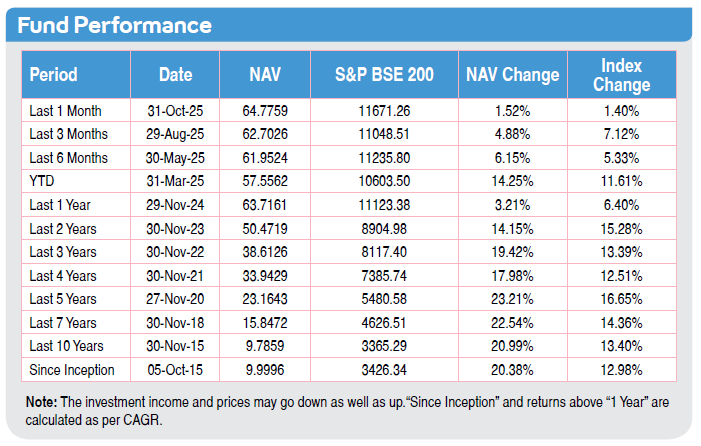

High-Rated Funds

Our fund options are highly rated 4 or 5 stars5 by Morningstar6. You can choose the fund options based on your risk appetite.

FOR EXISTING POLICY

FOR EXISTING POLICY  1860 266 9966

1860 266 9966

FOR NEW POLICY

FOR NEW POLICY