The best savings plans in India are low-risk investment options that combine life cover with a disciplined approach to wealth creation. As reliable long-term financial planning tools, they help you save systematically to meet future goals, fulfil important needs, and manage financial commitments with confidence.

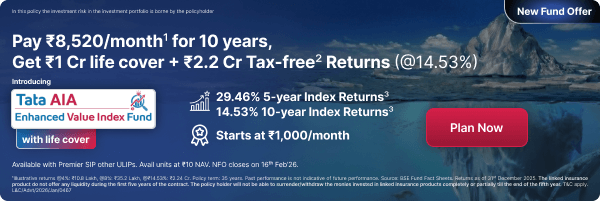

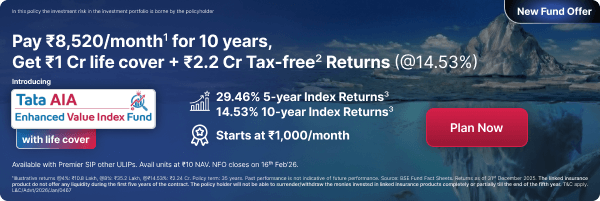

The best life insurance savings plan offers dual benefits, generating wealth over time and providing comprehensive life insurance coverage. Many guaranteed* returns savings plan also ensure a lump sum payout to your beneficiary in case of an unfortunate event, safeguarding your family’s financial stability.

Additionally, certain plans serve as tax-saving investment options, enabling you to optimise returns while enjoying tax1 benefits. By acting as a dependable insurance-cum-investment plan, savings plans support financial growth while ensuring long-term security.

FOR EXISTING POLICY

FOR EXISTING POLICY  1860 266 9966

1860 266 9966

FOR NEW POLICY

FOR NEW POLICY

Independent Purchase: When buying Tata AIA's savings plan online, you can carry out your research, refer to our plan brochures, compare different plans and make an informed decision.

Independent Purchase: When buying Tata AIA's savings plan online, you can carry out your research, refer to our plan brochures, compare different plans and make an informed decision.