Term Insurance Tax Benefits under Specific Sections of the Income Tax Act, 1961

Term insurance is a type of life insurance policy that provides risk coverage. It provides a lump sum to the nominee in case of the policyholder’s demise during the policy term. This payout is completely tax-free under Section 10(10D) of the Income Tax Act.

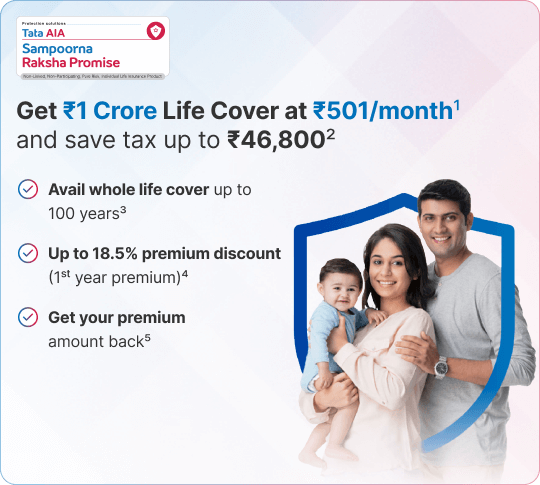

Premiums paid towards term insurance are eligible for tax6 deductions under Section 80C, up to ₹1.5 lakh per financial year, thereby reducing the taxable income. Additionally, the term insurance tax benefit 80D may be claimed if the policy includes critical illness or health-related riders7.

The key provisions applicable for tax benefits on term insurance include Section 80C, Section 80D, and Section 10(10D) of the Income Tax Act. Together, these sections may offer financial protection along with potential tax savings, depending on the policy features.

FOR EXISTING POLICY

FOR EXISTING POLICY  1860 266 9966

1860 266 9966

FOR NEW POLICY

FOR NEW POLICY

For term policies issued on or before March 31, 2012, the deduction will be restricted to 20% of the sum assured. E.g., if the sum assured is 30,000 and the premium is ₹8,000, Up to ₹6,000 can be claimed as a deduction.

For term policies issued on or before March 31, 2012, the deduction will be restricted to 20% of the sum assured. E.g., if the sum assured is 30,000 and the premium is ₹8,000, Up to ₹6,000 can be claimed as a deduction.

Step 1: Understand Applicable Tax Sections

Step 1: Understand Applicable Tax Sections Step 2: Collect Premium Payment Proofs

Step 2: Collect Premium Payment Proofs Step 3: File ITR with Correct Details

Step 3: File ITR with Correct Details Step 4: Verify Tax-Free Payout Eligibility

Step 4: Verify Tax-Free Payout Eligibility