Health and Wellness

Mission

TATA AIA aims to inspire people to embrace a healthy lifestyle, while transforming the way they approach wellness and protection.

We at Tata AIA Life Insurance believe that protection is not just about buying life insurance coverage; but about holistic protection extending beyond physical health, maintaining a healthy lifestyle and taking care of mental & emotional health too. We have conceptualized and curated our unique health and wellness solutions that will help you stay motivated, reach your fitness goals, and unlock a gamut of discounts and other benefits for you.

Click here to know more about our products with Vitality

Transform the way you approach fitness while making every step of your journey incredibly rewarding and fulfilling.

Health & Wellness Mission

TATA AIA aims to inspire people to embrace a healthy lifestyle, while transforming the way they approach wellness and protection.

We at Tata AIA Life Insurance believe that protection is not just about buying life insurance coverage; but about holistic protection extending beyond physical health, maintaining a healthy lifestyle and taking care of mental & emotional health too. We have conceptualized and curated our unique health and wellness solutions that will help you stay motivated, reach your fitness goals, and unlock a gamut of discounts and other benefits for you.

Click here to know more about our products with Vitality

Transform the way you approach fitness while making every step of your journey incredibly rewarding and fulfilling.

Health & Wellness Benefits for you

Wellness encompasses more than just physical fitness. Hence, our wellness program1 takes a holistic approach, focusing on 360-degree solutions.

Beside the upfront discount on purchase of a health & wellness solution (Life insurance product with Vitality health rider) the Life Insured has access to our Health & wellness program through the Vitality app, which helps in maintaining a healthy lifestyle , access to health care through medical teleconsultation and personal medical case management.

Holistic Wellness Program1 -Tata AIA Vitality^

The Tata AIA Vitality^ is a holistic wellness program1 that helps you understand and improve your health with benefits of premium discounts under the insurance product. The Tata AIA Vitality App is the partner in the Life Insured journey towards holistic wellbeing. It helps you learn about your health through the various assessments and health checks and drives you to improve your health via personalised weekly physical activity challenges. Earn points for all the activities you do and enjoy benefits like premium discount.

Holistic Wellness Program -Vitality

The Tata AIA Vitality is a holistic wellness program that helps you understand and improve your health with benefits of premium discounts under the insurance product. The Tata AIA Vitality App is the partner in policyholder journey towards holistic wellbeing. It helps you learn about your health through the various assessments and health checks and drive your physical activity through motivational challenges. Earn points for all the activities you do and enjoy benefits like premium discount.

Know where you stand on your wellness journey

Check your Fitness Quotient

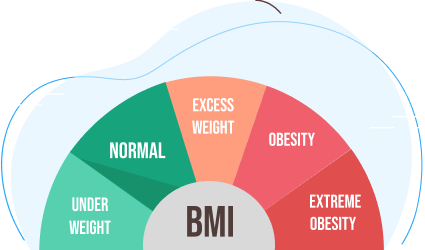

BMI index widely used as a general indicator of whether an adult has a healthy body weight for their height.

Generally, an individual should try to maintain a BMI below 25 kg/m2, as being overweight or underweight can have significant health effects, however while BMI is an imperfect measure of healthy body weight, it is a useful indicator of whether any doctor consultation or additional testing is required.

Do you know what does your BMI say about your overall height to body weight ratio? Enter your details to calculate below.

Measure your BMI :

Success

Explore our Financial Calculators

Along with physical health, it is equally important to be aware of financial health to maintain financial well-being and stay prepared for any unforeseen unfavourable circumstances. The below calculators will help you identify your financial preparedness.

Binge on Fun Quiz to find your Financial Personality

Have you ever wondered why your best friend’s saving advice doesn’t suit you so well? Or you find it hard to follow the investment plan as guided by a trusted colleague or family member?

Well, because every individual has a different Financial personality, that shapes up their spending, saving and investment pattern.

Our personality quiz is designed to help you find your Financial personality and also recommends the perfect plans that suit your personality.

Life Insurance Products with embedded Health program

‘Health is Wealth’ as the age-old adage says, and this timeless wisdom continues to hold true even today. When you are healthy, your chances of growing in wealth increase manifold. Tata AIA believes in this and deeply cares for it’s customer’s thereby offering a range of benefits through Health & wellness solutions.

Explore our range of products with embedded health & wellness benefits to be activated on purchase, which includes access to wellness program1 with upfront rider premium discount2 and much more.

Health and Lifestyle Articles

Stay updated with our wide range of articles and blogs on Health & Wellness, with guidance and tips to maintain a healthier lifestyle, manage your stress, eat clean and many more.

FAQs

-

Is the Wellness Program an optional benefit?

Yes, the - Wellness Program - Tata AIA Vitality is an optional benefit that you can choose when adding the health rider to your base plan. You can only opt in for this program at the time of buying the policy. Infact, you get an upfront discount on your 1st year rider premium on enrolling into the Wellness Program. With this Wellness Program, you can keep track of your health and fitness goals and get rewarded to maintain healthy lifestyle.

-

How can this rider enhance the coverage of the base policy?

By adding this rider in your policy, you can receive coverage against a range of major conditions as well as minor illnesses and injuries as specified under the rider. For instance, with the HospiCare Benefit, you can be covered for Hospitalization Expenses and ICU expenses whereas Cancer Care benefit covers you against early as well as late-stage Cancers

-

What are the benefits of opting for the Wellness Program?

The Wellness program incentivizes the Insured to maintain a healthy lifestyle. On enrolling into the Wellness Program, you get an upfront discount on your 1st year rider premium. You can keep track of your health and fitness goals and your engagement levels shall be monitored and a Wellness Status shall be earned throughout the year that shall be used to determine the Premium discount for the following year.

-

How can the benefit under this rider be paid out?

The benefits under this rider can be paid out in a mode chosen by the insured on the occurrence of the conditions/illnesses/events covered under the different benefit options. These modes are:

Benefit pay out as a lump sum amount

Benefit pay out as monthly income for 10 years

A combination of monthly income and lump sum payout

-

How do I reach out to Tata AIA Life Insurance to file a claim?

You can reach out to Tata AIA Life Insurance and file a claim through the following channels:

Call us on 1-860-266-9966 (local charges apply)

Send us an email at customercare@tataaia.com

Or, you can also get in touch with our Insurance Advisor or visit the nearest Tata AIA Life Insurance office branch. For more details, please visit www.tataaia.com

-

Disclaimers

- Insurance cover is available under the product.

- The products are underwritten by Tata AIA Life Insurance Company Ltd.

- The plans are not a guaranteed issuance plan and it will be subject to Company’s underwriting and acceptance.

- For more details on risk factors, terms and conditions please read sales brochure carefully before concluding a sale.

- 1Tata AIA Vitality - A Wellness Program that offers you an upfront discount at policy inception. You can also earn premium discount / cover booster (as applicable) for subsequent years on policy anniversary basis your Vitality Status (tracked on Vitality app) (2) Please refer rider brochures for additional details on health and wellness benefits.

- 2On enrolling into the wellness Program, you get an upfront discount of 5% on first year premium for Accidental Death, Accidental Total & Permanent Disability, Accidental Disability Care Benefits and of 10% on first year premiums of the other benefit options. The rewards are offered on cumulative basis and in any year, the maximum rewards in view of both the upfront rewards and annual rewards _ex together shall be 15% for Accidental Disability Care and 30% for all other benefit options. Discount is driven by accumulated points which is achieved through wellness status. Please refer policy document for more details.

- 3Guaranteed Income shall be a fixed percentage of the Annualised Premium / Single Premium (excluding discount) payable in a year. Guaranteed Annual Income as per the chosen Income Frequency shall commence after maturity till the end of the Income Period, irrespective of survival of the life insured(s) during the Income Period.

- 4Income Tax benefits would be available as per the prevailing income tax laws, subject to fulfillment of conditions stipulated therein. For ULIP policies, maturity income will be taxable if annual aggregate premium exceeds ₹2.5 Lakh in a financial year. For non ULIP insurance policies, maturity income will be taxable if annual aggregate premium exceeds ₹5 Lakh in a financial year. Tax laws are subject to change from time to time. Tata AIA Life Insurance Company Ltd. does not assume responsibility on tax implications mentioned anywhere on this site. Please consult your own tax consultant to know the tax benefits available to you.

- 5Available under Regular Income with an Inbuilt Critical Illness Benefit option.

- 6Tax benefits of up to ₹46,800 u/s 80C is calculated at highest tax slab rate of 31.20% (including cess excluding surcharge) on life insurance premium paid of ₹1,50,000 as per old tax regime. Tax benefits under the policy are subject to conditions laid under Section 80C, 80D,10(10D), 115BAC and other applicable provisions of the Income Tax Act,1961. Good and Service tax and Cess, if any will be charged extra as per prevailing rates. The Tax Free income is subject to conditions specified under section 10(10D) and other applicable provisions of the Income Tax Act,1961. Tax laws are subject to amendments made thereto from time to time. Please consult your tax advisor for details, before acting on above.

- 7The premium paid in Unit Linked Life Insurance policies are subject to investment risks associated with capital markets and the NAVs of the units may go up or down based on the performance of fund and factors influencing the capital market and the insured is responsible for his/her decisions. The various funds offered under this contract are the names of the funds and do not in any way indicate the quality of these plans, their future prospects and returns. On survival to the end of the policy term, the Total Fund Value including Top-Up Premium Fund Value valued at applicable NAV on the date of Maturity will be paid

- 8Subject to a maximum term of 40 years

- Vitality is a trademark licensed to Tata AIA Life by Amplify Health Assets PTE. Limited, a joint venture between Vitality Group International, INC. and AIA Company Limited. The assessment under the wellness program shall not be considered as a medical advice or a substitute to a consultation/treatment by a professional medical practitioner.

- Tata AIA Life Insurance Sampoorna Raksha Supreme is also available individually for sale.

- Tata AIA Life Insurance Smart Sampoorna Raksha is also available individually for sale.

- The fund is managed by Tata AIA Life Insurance Company Ltd. For more details on risk factors, terms and conditions please read Sales Brochure carefully before concluding a sale. The precise terms and condition of this plan are specified in the Policy Contract.

- Past performance is not indicative of future performance. Returns are calculated on an absolute basis for a period of less than (or equal to) a year, with reinvestment of dividends (if any).

- Investments are subject to market risks. The Company does not guarantee any assured returns. The investment income and price may go down as well as up depending on several factors influencing the market.

- Please make your own independent decision after consulting your financial or other professional advisor.

- Tata AIA Life Insurance Company Limited is only the name of the Insurance Company & Tata AIA Life Insurance Smart Sampoorna Raksha is only the name of the Unit Linked Life Insurance contract and does not in any way indicate the quality of the contract, its future prospects or returns.

- Unit Linked Life Insurance products are different from the traditional insurance products and are subject to the risk factors. Please know the associated risks and the applicable charges, from your Insurance Agent or Intermediary or Policy Document issued by the Insurance Company.

- Various funds offered under this contract are the names of the funds and do not in any way indicate the quality of these plans, their future prospects and returns. The underlying Fund's NAV will be affected by interest rates and the performance of the underlying stocks.

- The performance of the managed portfolios and funds is not guaranteed, and the value may increase or decrease in accordance with the future experience of the managed portfolios and funds.

- Premium paid in the Unit Linked Life Insurance Policies are subject to investment risks associated with capital markets and the NAVs of the units may go up or down based on the performance of fund and factors influencing the capital market and the Insured is responsible for his/her decisions.

- Please know the associated risks and the applicable charges, from your insurance agent or the Intermediary or policy document issued by the Insurance Company.

IN THIS POLICY, THE INVESTMENT RISK IN INVESTMENT PORTFOLIO IS BORNE BY THE POLICYHOLDER. THE LINKED INSURANCE PRODUCT DO NOT OFFER ANY LIQUIDITY DURING THE FIRST FIVE YEARS OF THE CONTRACT. THE POLICY HOLDER WILL NOT BE ABLE TO SURRENDER/WITHDRAW THE MONIES INVESTED IN LINKED INSURANCE PRODUCTS COMPLETELY OR PARTIALLY TILL THE END OF THE FIFTH YEAR.

L&C/Advt/2023/Oct/3777

Tata AIA Life Insurance Company Ltd. (IRDA Regn. No. 110 ·CIN:U66010MH2000PLC128403. Registered & Corporate Office: 14th Floor, Tower A, Peninsula Business Park, Senapati Bapat Marg, Lower Parel, Mumbai 400013. Trade logo displayed above belongs to Tata Sons Ltd and AIA Group Ltd. and is used by Tata AIA Life Insurance Company Ltd under a license. For any information including cancellation, claims and complaints, please contact our Insurance Advisor/Intermediary or visit Tata AIA Life's nearest branch office or call 1-860-266-9966 or write to us at customercare@tataaia.com. Visit us at www.tataaia.comBEWARE OF SPURIOUS PHONE CALLS AND FICTITIOUS / FRAUDULENT OFFERS

IRDAI is not involved in activities like selling insurance policies, announcing bonus or investment of premiums. Public receiving such phone calls are requested to lodge a police complaint.