T&C Apply1

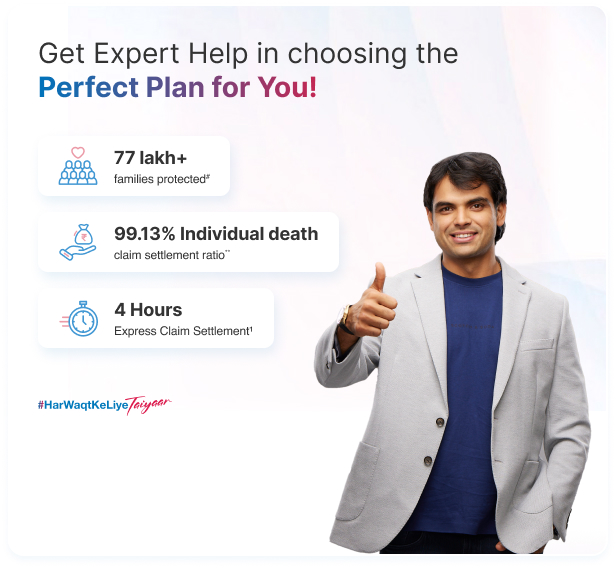

Meet Tata AIA Life Planner

Why Choose Tata AIA Life Insurance?

Voice of happy customers

- 1Applicable to only non-early claims more than 3 years of policy duration, non-investigation cases, up to Sum assured of 50 lacs. Applicable for branch walk in. Time limit to submit claim to Tata AIA by 2 pm (working days). Subject to submission of complete documents. Not applicable to ULIP policies and open title claims.

- **Individual Death Claim Settlement Ratio is 99.13% for FY 2023 - 24 as per the latest annual audited figures.

- #77,26,727 families protected till December ’23

- ~Retail Sum Assured for FY23 is Rs 4,43,479 Crores.

- $As on 03rd April 2024, the company has a total Assets Under Management (AUM) of Rs.100,099.11 Crores

- For more details on risk factor, terms and conditions under the product, please read Sales brochure carefully before concluding a sale.

- L&C/Advt/2024/Dec/4016