Call us

Call us

Tata AIA Wealth Pro is a life insurance wealth plan which helps you create wealth over the medium-to-long term through consistent investment in equity markets. Multiple fund options to choose from and life cover under the policy gives you a comprehensive solution for wealth creation and financial protection.

Our experts are happy to help you!

Grow your corpus with market linked# returns

Regular Loyalty Additions## to boost investments

Flexibility to pay premium one time or for a limited period as per your choice

Life insurance coverage up to 80 years of age.

Option to switch your investment between different funds under the same policy.

Get Income Tax~ benefits as per applicable Income Tax laws

Option to customize your plan with three additional unit deducting riders^

The following riders^ are available under the Tata AIA Wealth Pro:

Linked, Individual, Health Insurance Rider (UIN:110A026V02 or later)

Linked, Individual, Health Insurance Rider (UIN:110A025V02 or later)

Linked Individual, Health Insurance Rider (UIN:110A027V02 or later)

A Non-Linked, Non- Participating Individual Health rider (UIN: 110A048V03 or any other later version)

A Non-Linked, Non- Participating Individual Health rider (UIN: 110A047V02 or later)

A Non-Linked, Non- Participating Individual Health rider (UIN: 110A031V03 or later)

A Non-Linked, Non- Participating Individual Health rider (UIN: 110A032V03 or later)

Your claims are settled within 4 hours^^

Our funds have been rated 4 or 5 stars@ by Morningstar**

99.13% Individual Death Claim Settlement Ratio~~ in FY 2023 - 24

Save income tax~ as per applicable income tax laws

^^T&C apply

Plan Eligibility

| Minimum Issue Age | 0 years (30 days) | |||

| Maximum Issue Age | 65 years | |||

| Minimum Maturity Age | 18 years | |||

| Maximum Maturity Age | 80 years | |||

| Policy Term | 6 – 40 years | |||

Premium Paying Term |

Single Pay | |||

| Limited Pay – 5 to 20 years | ||||

| Regular/Limited Pay – 12 to 40 years | ||||

| Pay Mode | You can pay your premiums with Single, Annual, Semi-Annual, Quarterly, Monthly mode | |||

Minimum Premium |

Single Pay – ₹5,00,000 | |||

| Regular/Limited Pay – ₹2,50,000 per annum | ||||

| Maximum Premium1 | There is No Limit | |||

Minimum Basic Sum Assured |

Age up to 49 | |||

| Single Pay – 1.25 times Single Premium | ||||

| Limited Pay/ Regular Pay – 7 times Annualised premium | ||||

| Age 50 and above | ||||

| Single Pay –1.10 times Single Premium | ||||

| Limited Pay/ Regular Pay – 5 times Annualised premium | ||||

| Age is as of last birthday | ||||

Maximum Basic Sum Assured |

For Single Pay | |||

| Max Multiple of Single Premium | ||||

| Entry Age / Policy Term | Up to 10 | 11 to 20 | >20 | |

| < =35 | 10 | 5 | 1.25 | |

| 36 to 40 | 7 | 5 | 1.25 | |

| 41 to 45 | 5 | 1.25 | 1.25 | |

| > 45 | 1.25 | 1.25 | 1.25 | |

| For Regular/Limited Pay – | ||||

| Entry Age Band | Maximum Multiple of AP | |||

| 0 to 29 | Higher of (Policy Term/2 or 30) | |||

| 30 to 35 | Higher of (Policy Term/2 or 20) | |||

| 36 to 45 | Higher of (Policy Term/2 or 15) | |||

| 46 to 65 | Higher of (Policy Term/2 or 10) | |||

| AP is Annualised Premium, and it means the premium amount payable in a year excluding the taxes, rider premiums and underwriting extra premiums on riders, if any All reference to age is as on last birthday. | ||||

Our experts are happy to help you!

What is a unit-linked insurance plan?

A unit-linked insurance plan is a life insurance plan that enables you to invest your money in different fund options offered under the policy. A unit-linked insurance plan offers market-linked returns and life insurance coverage under the same life insurance policy.

Do ULIPs offer guaranteed returns?

No, ULIPs do not offer guaranteed returns since the returns are market-linked and can fluctuate as per the market movements. However, such policies do enable you to choose from suitable fund options as per your risk profile and investment goal so that you can create and grow your wealth through the investment.

Does ULIP offer death benefits?

Yes, a Unit-Linked Insurance Plan offers death benefits in the form of the sum assured, which is payable if the policyholder passes away during the policy term.

What documents would I require to buy an insurance policy?

You will have to submit the following mandatory documents to buy an insurance policy.

Proof of address:

The following documents are accepted as valid proof of your address.

Proof of identity:

Some of the documents that are accepted as valid proof of your identity include:

Documents showing proof of income:

These documents, which are required only for a few plans, include:

What are the premium payment terms offered under Tata AIA Life Insurance Wealth Pro?

The premium payment terms offered under Tata AIA Wealth Pro are:

How long does the cover offered by Tata AIA Wealth Pro last?

The cover offered by the Tata AIA Wealth Pro plan is valid till you attain 80 years of age.

How will the minimum basic sum assured of the Tata AIA Wealth Pro be calculated?

The minimum basic sum assured for the Tata AIA Wealth Pro will be calculated as follows based on the entry age –

Up to age 49 years

Single Pay – 1.25 times Single Premium

Limited Pay/ Regular Pay – 7 times Annualised premium

Age 50 years & above

Single Pay –1.10 times Single Premium

Limited Pay/ Regular Pay – 5 times Annualised premium

Age is as of last birthday

How will the maximum basic sum assured of the Tata AIA Wealth Pro be calculated?

The minimum basic sum assured for the Tata AIA Wealth Pro will be 1.25 or 1.10 times the Single Premium for Single Pay, while the entry age band will determine the minimum/maximum multiple of the Annualised Premium for the Regular and Limited Pay policies. Refer ‘Plan Eligibility’ section above for details

Can I calculate my ULIP returns online?

Yes, ULIP returns can be calculated online with the help of a ULIP return calculator available on the official website of Tata AIA Life Insurance. This online and free-of-cost tool helps you factor in inflation and interest rates to give you an estimate of your expected returns.

How can I raise a claim under this life insurance wealth policy?

you can choose any of the following channels to reach out to us and raise a claim.

Email us at customercare@tataaia.com

Call our helpline number - 1860-266-9966 (local charges apply)

Walk into any of the TALIC branch offices

Write directly to us at

The Claims Department,

Tata AIA Life Insurance Company Limited

B- Wing, 9th Floor,

I-Think Techno Campus,

Behind TCS, Pokhran Road No.2,

Close to Eastern Express Highway,

Thane (West) 400 607.

IRDA Regn. No. 110

Do I need to file death benefits claim under the Tata AIA Wealth Pro plan?

Your nominee will have to file death benefits claim under this policy after your demise within the policy term. They can do so by submitting the documents to us online or through email.

Should I file a claim to make partial withdrawals from my funds?

No, withdrawing money from your investment funds after a period of 5 years from the date of the wealth policy being issued does not require a claim. You can withdraw the funds completely or partially as per your needs by notifying us about the withdrawal. There are no charges associated with 4 partial withdrawals each year.

Can my nominee file a claim from another country?

Yes, your nominee can file a claim from abroad either on our official website or send us the required claim documents via email. If they want to file the claim offline, they can send the documents to their representative in India, who can visit any of our office branches and submit the documents.

Popular Searches

Disclaimer

LINKED INSURANCE PRODUCTS DO NOT OFFER ANY LIQUIDITY DURING THE FIRST FIVE YEARS OF THE CONTRACT. THE POLICY HOLDER WILL NOT BE ABLE TO SURRENDER/ WITHDRAW THE MONIES INVESTED IN LINKED INSURANCE PRODUCTS COMPLETELY OR PARTIALLY TILL THE END OF THE FIFTH YEAR.

The complete name of Tata AIA Wealth Pro is Tata AIA Life Insurance Wealth Pro (UIN: 110L111V05) – Non-Participating, Unit Linked, Individual Life Insurance Savings Plan

^Rider is not mandatory and is available for a nominal extra cost. For more details on benefits, premiums, and exclusions under the Rider, please contact Tata AIA Life’s Insurance Advisor/ branch.

Tata AIA Waiver of Premium (Linked) Rider - Linked, Individual, Health Insurance Rider (UIN:110A026V02 or later), Tata AIA Waiver of Premium Plus (Linked) Rider - Linked, Individual, Health Insurance Rider (UIN:110A025V02 or later), Tata AIA Accidental Death and Dismemberment (Long Scale) (ADDL) Linked Rider – Linked Individual, Health Insurance Rider (UIN:110A027V02 or later), Tata AIA Vitality Protect Plus - A Non-Linked, Non- Participating Individual Health rider (UIN: 110A048V03 or any other later version), Tata AIA Vitality Health Plus - A Non-Linked, Non- Participating Individual Health rider (UIN: 110A047V02 or later), Tata AIA Life Insurance Linked Comprehensive Health Rider - A Non-Linked, Non- Participating Individual Health rider (UIN: 110A031V03 or later), Tata AIA Life Insurance Linked Comprehensive Protection Rider- A Non-Linked, Non- Participating Individual Health rider (UIN: 110A032V03 or later) are available under this plan

~Income Tax benefits would be available as per the prevailing income tax laws, subject to fulfilment of conditions stipulated therein. Income Tax laws are subject to change from time to time. Tata AIA Life Insurance Company Ltd. does not assume responsibility on tax implications mentioned anywhere on this site. Please consult your own tax consultant to know the tax benefits available to you.

#Market-linked returns are subject to market risks and terms & conditions of the product. The assumed rate of returns or illustrated amount may not be guaranteed and depends on market fluctuations.

##Loyalty Additions will be credited only if Policy is in-force and all due premiums have been paid. For Regular Pay, additional units @ 0.20% of units in each of the funds under Regular Premium Account will be credited (post deduction of applicable charges) to the respective funds every Policy Anniversary starting from eleventh (11th) Policy Anniversary till end of Policy Term. For Single Pay, additional units @ 0.35% of units in each of the funds under the Single Premium Account will be credited (post deduction of applicable charges) to the respective funds every policy anniversary starting from sixth (6th) Policy Anniversary till end of Policy Term. Loyalty Additions are not payable on Top-up Premium Account

@All funds open for new business which have completed 5 years since inception are rated 4 star or 5 star by Morningstar as of August 2024.

**©2024 Morningstar. All rights reserved. The Morningstar name is a registered trademark of Morningstar, Inc. in India and other jurisdictions. The information contained here: (1) includes the proprietary information of Morningstar, Inc. and its affiliates, including, without limitation, Morningstar India Private Limited (“Morningstar”); (2) may not be copied, redistributed or used, by any means, in whole or in part, without the prior, written consent of Morningstar; (3) is not warranted to be complete, accurate or timely; and (4) may be drawn from data published on various dates and procured from various sources and (5) shall not be construed as an offer to buy or sell any security or other investment vehicle. Neither Morningstar, Inc. nor any of its affiliates (including, without limitation, Morningstar) nor any of their officers, directors, employees, associates or agents shall be responsible or liable for any trading decisions, damages or other losses resulting directly or indirectly from the information.

^^Applicable to only non-early claims with more than 3 years of policy duration, non-investigation cases, up to Sum Assured of Rs. 50 lakhs. Applicable for branch walk in. Time limit to submit claim to Tata AIA Life Insurance is 2 pm on working days. Subject to submission of complete documents. Not applicable for ULIP policies and open title claims.

~~Individual Death Claim Settlement Ratio is 99.13% for FY 2023 - 24 as per the latest annual audited figures.

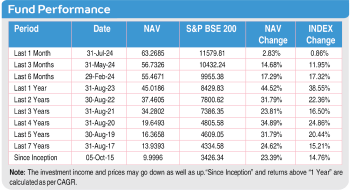

25-year computed NAV for Multi Cap Fund as of Aug 2024. Other funds are also available. Benchmark of this fund is S&P BSE 200.

Tata AIA Life Insurance Company Limited is only the name of the Insurance Company & Tata AIA Life Insurance Wealth Pro – Non-Linked, Unit Linked, Individual Life Insurance Savings Plan (UIN: 110L111V05) - is only the name of the Unit Linked Life Insurance contract and does not in any way indicate the quality of the contract, its future prospects or returns.

The fund is managed by Tata AIA Life Insurance Company Ltd.

For more details on risk factors, terms and conditions please read Sales Brochure carefully before concluding a sale. The precise terms and condition of this plan are specified in the Policy Contract.

Past performance is not indicative of future performance. Returns are calculated on an absolute basis for a period of less than (or equal to) a year, with reinvestment of dividends (if any).

Investments are subject to market risks. The Company does not guarantee any assured returns. The investment income and price may go down as well as up depending on several factors influencing the market.

The underlying Fund's NAV will be affected by interest rates and the performance of the underlying stocks.

Please make your own independent decision after consulting your financial or other professional advisor.

The performance of the managed portfolios and funds is not guaranteed, and the value may increase or decrease in accordance with the future experience of the managed portfolios and funds.

Please know the associated risks and the applicable charges, from your insurance agent or the Intermediary or policy document issued by the Insurance Company.

Insurance cover is available under the product.

The products are underwritten by Tata AIA Life Insurance Company Ltd.

The plans are not a guaranteed issuance plan, and it will be subject to Company’s underwriting and acceptance.

For more details on risk factors, terms and conditions please read sales brochure carefully before concluding a sale.

L&C/Advt/2024/Sep/2666