In life insurance, your policy can be customized according to your unique needs. While there are a variety of life insurance plans available in the market such as Savings, Unit-Linked Insurance Plan (ULIP), Pension, Term and Health Insurance Plans, these can be supplemented with Riders in order to enhance protection of your base policy.

A. What are riders?

A rider is typically an add-on to the conventional life insurance policy. It is designed to provide coverage over and above that of the primary policy, at an additional premium. It is an effective way to maximize benefits of a life insurance policy and tailor it to fit your needs

Rider benefits come into effect on the occurrence of the stipulated event (as mentioned in the policy) so that you get financial cover on top of the basic sum assured.

B. What are the different types of riders?

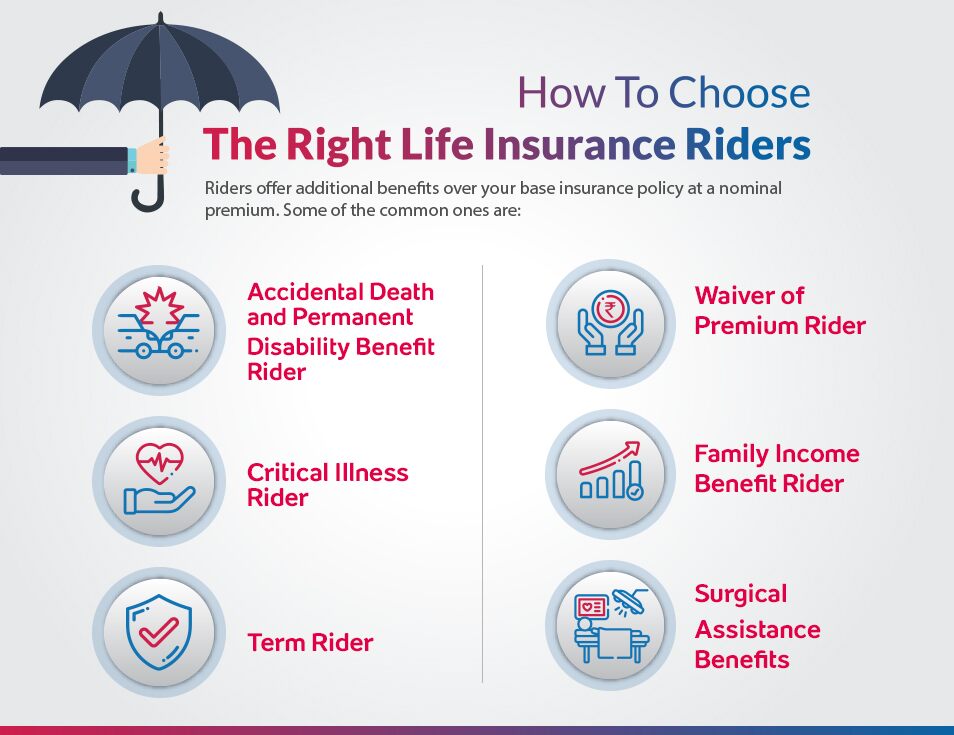

There are a range of riders and some of the most common riders are:

1. Accidental Death and Permanent Disability Benefit Rider

Accidents, in some cases, can lead to permanent disability or even premature death. Such a situation can hurt a family’s finances and potentially derail every life goal.

Therefore, in order to safeguard financial well-being, one can consider an additional cover – besides the base death benefit that a policy offers there would be additional benefit payable upon death or permanent disability resulting from an accident.

2. Critical Illness Rider

With this rider, the insured would get a pay-outon being diagnosed with a critical illness. Generally, such illnesses include kidney failure, coronary artery bypass surgery (CABG), cancer, heart attack and paralytic stroke, among others.

However, this list varies across insurers. Moreover, unlike a mediclaim, the insured need not furnish any treatment bill as the amount would be paid out, regardless of the expenses incurred towards medical care..

3. Term Rider

A term rider promises an extra amount to the nominee, usually equivalent to the base sum assured, on death of the life insured.

4. Waiver of Premium (WoP) Rider

A permanent disabilitycan impair one’s earning abilities. This can affect a family’s financial well-being.In such a situation, the inability to pay life insurance premiums might result in a policy lapse.

It is here that a Waiver of Premium rider can come in handy, wherein the insurer would waive off allfuture premiums payable towards the base plan. However, policy benefits would continue as they were.

5. Family Income Benefit Rider

This rider serves to provide a steady stream of income to the familyupon death (or total disability) of the life insured.

It is advisable that at the time of purchase, you decide on the exact number of years you’d want your family to receive the additional income benefit.

6. Surgical Assistance Benefit

This rider offers financial assistance in case of a medical emergency that might require surgical intervention. However, if more than one surgery is performed in one confinement, the total pay-out should not exceed the amount of coverage from this rider.

C. How to choose the most effective rider?

While all the riders serve specific purposes, it is essential that your choice depends on a thorough evaluation of your needs.

For instance, aCritical Illness Rider can assume importance, considering sum assured is often equal to the basecoverage and pay-outs are flexible. Moreover, if your family has a history of criticalillnesses, you should certainly opt for this rider. That’s because it can help you meet high treatment costs of critical ailments.

Importantly, if you are the sole bread-winner of your family, it is advisableyou consider a CriticalIllness Riderand an Accidental Death and Permanent Disability Benefit Rider. That’s because coverage, in mostcases, kicks into effect upon diagnosis (of the condition) or sustaining the disability. This way, theprimary objective of income replacement is taken care of.

In conclusion, note that the conditions attached with the base policy will govern aspects, such as term of the rider, sum assured and age at entry. Also, premiums paid towards health-related riders, such as Critical Illness Rider, will qualify for tax exemption under Sec 80D of the IT Act. However, premiums paid towards other riders are eligible for tax relief under Sec 80C.

FOR EXISTING POLICY

FOR EXISTING POLICY

FOR NEW POLICY

FOR NEW POLICY