4 Tips To Build An Education Corpus For Your Child

3-June-2021 |

As a parent, you want to see your child achieve their dreams, and you want to support their every goal and milestone. With a lifetime of potential before them, a child education plan is one of the best ways to equip your child well for the future. While you may feel that it’s premature and there’s still plenty of time when you’re changing their onesie, it’s not! With the rising costs of education, it’s essential to have a plan and execute it at the earliest so you can create a substantial corpus and set them on the right course. The sooner you begin, the further ahead you’ll get to building a solid foundation. Let’s explore the different ways to build an education corpus for your child for their success.

1. Plan the costs and set a target amount

One of the first steps to plan for your child’s education is to estimate what the total cost is likely to be. Since there’s no one-size-fits-all approach to setting the right amount for your child’s education, you can use current fee and tuition figures to get an approximate amount, which you can adjust for inflation over time. Alternatively, a more accurate method is using a child education expense calculator, which helps forecast future expenses.

The cost of education can vary drastically for every child and parent. It entirely depends on the type of course that interests your child. Comparatively, professional courses and private colleges cost more. Similarly, overseas education is more expensive. Thus, when you have a goal in mind, you can work backward to achieve it. It’s always better to have a higher estimate.

2. Start saving early

As with all monetary goals, the rule of thumb is to start as early as you can. This way, time is on your side. The longer you have, the more funds you can amass and interest you can accumulate. Ideally, the best time to start saving for your child’s education is after your child is born.

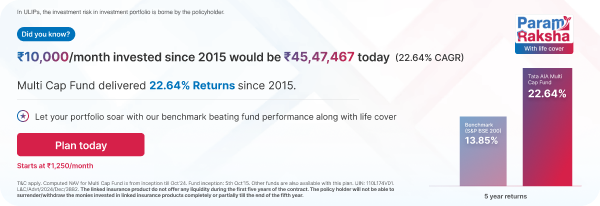

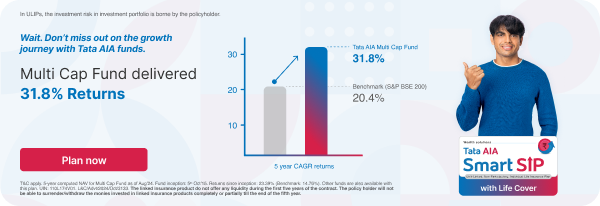

With regular investments and compound interest, your funds have the opportunity to grow, so you can comfortably put aside a certain portion to reach your child’s education goals. At the same time, contributing a little over a larger period ensures you don’t have to compromise on your retirement investments or other financial goals. All your funds can accrue interest and grow.

Plus, with the uncertainties of life springing surprises and setbacks, the longer duration gives you some leeway to rebound and recover from adverse events. If you start saving when the deadline is a few years away, you won’t have sufficient time to bounce back when things hit you out of the blue, or worse, you will simply not have enough funds.

3. Know your investment and savings options

Along with starting early, parents must invest right to get optimum returns. Your long-term financial targets may be steep, and so, a combination of the right tools like financing methods and investment vehicles will work best to get you there. Say you have 15 years to save, and it’s difficult to predict the exact funds you will need later. Therefore, you have to look at different instruments to accumulate funds.

When you first begin, you can start with a good old-fashioned savings account. It’s one of the safest and trusted ways to save. Depending on where you have the account, you can accrue about 2% interest per year. Like this, there are several options.

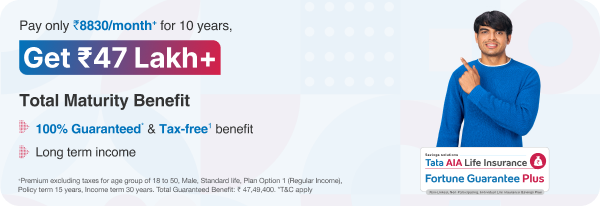

Based on your risk appetite and knowledge, you can pick the right path. For instance, traditional life insurance policies offer five to six percent per year. Although on the lower side, the returns are assured and tax-free*. Similarly, equity mutual funds have the potential to deliver high interest returns. A safe bet is a guaranteed return plan. Such plans are designed to help you save systematically and regularly. And they give you the flexibility to plan your future goals with guaranteed returns.

No matter which instrument you pick, it’s crucial to review your investments and assess if it’s making the progress you desire. If your returns are low or falling short of your expectations, introducing a little risk or tweaking it will help you maximize rewards. If it’s doing well, instead of exposing it to the market, you may want to secure the capital.

4. You need to think long term

The key to achieving your financial goals is formulating a plan and sticking to it with dedication. But starting early is extremely important. However, sometimes, it’s easy to lose sight of your target as the end goal seems several years away. But no matter what, you need to stick to your plan and always refocus on your goal.

No doubt, the sky-high requirements, and life’s uncertainties can leave you overwhelmed. But remember, you can always start small and step it up. Today if you earn ₹ 50,000 per month, you can save ₹ 10,000 monthly. In the coming year, if your income increases, you can increase your savings accordingly. The initial baby steps of savings will only become bigger with time.

When you think long-term, your funds stand the test of time. Plus, rather than stressing out when it’s time for college, you can sit back, relax, and plan how you’re going to spend your retirement years.

Forge Ahead!

Remember, building a child’s education fund is not a linear process. You will have to constantly change how you handle your finances and revisit your goals. Don’t be afraid to take risks where you can afford or adjust your investment strategy. No matter how big or small the target amount is, you will need creativity, flexibility, and commitment to achieve it. This hard work and planning pays off. The reward you get is knowing your child has a better chance at a brighter future.

FOR EXISTING POLICY

FOR EXISTING POLICY

FOR NEW POLICY

FOR NEW POLICY