1. What are multi-cap funds?

A multi-cap fund invests in large-cap, mid-cap, and small-cap companies, which enables diversification in its portfolios across all market capitalisations.

2. Are multi-cap funds safe?

Multi-cap funds invest in equities. If investing in multi-cap funds, ensure that your risk profile matches the portfolio risk.

3. Who should invest in a multi-cap fund?

Investors seeking long-term capital appreciation through investment in equities and wanting to invest in large-cap, mid-cap and small-cap companies can choose a multi-cap fund. One should also select a multi-cap fund if their capacity for risk matches the risk profile of the multi-cap fund.

4. Which is better, large-cap or multi-cap?

The choice between a large-cap or multi-cap fund will depend on the investor’s risk profile. An investment in a large-cap fund is considered less risky than a multi-cap fund investment. However, multi-cap funds allow greater diversification across market capitalisations and help generate long-term capital appreciation.

5. How do I choose a multi-cap fund?

These are the following points to consider while choosing a multi-cap fund: ● Since multi-cap funds invest in mid, small, and large-cap equities, they can be riskier than large-cap funds. Hence, investors whose risk tolerance matches the fund's risk profile may find multi-cap funds suitable. ● Multi-cap funds are meant to be long-term investments as they aim to offer long-term capital appreciation. You may consider a multi-cap fund if you are looking for a long-term investment in equities. ● Check the past performance of the multi-cap fund you want to invest in. Over the last 5 years, if the fund has performed well and offered steady returns, you can consider investing in it.

6. What is the fund switch facility?

The fund switch facility provided in Tata AIA Life Insurance ULIPs allow the investor to switch from one fund to another if the existing choice of funds does not meet the investor’s expectations. Tata AIA Life Insurance offers switching of funds for a policy year as per policy condition, during which the investor can move to other funds as and when needed.

7. How to check the fund NAV?

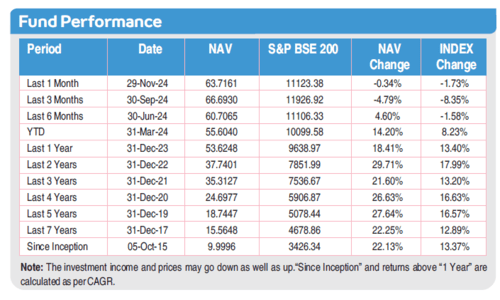

You can check our funds’ Net Asset Value (NAV) here. This is important for ULIP policyholders who have selected certain funds to invest in under their policy.

Just select the name of the fund and the time period to view the daily NAV. For instance, if you have invested in the Tata AIA Multicap Fund, you can select Tata AIA Multicap Fund in the dropdown.

8. What is the right time to buy a ULIP?

You can buy a ULIP when you have the financial capacity to start an investment and know how investments work. Since ULIPs combine life insurance and investment under the same policy, it is also advisable to purchase the policy in your 20s or early 30s so that the premium cost is reasonable and affordable. As you grow older, the premium amount will also increase.

9. How much can I invest in a ULIP?

The amount you want to invest in your ULIP will depend on your financial capacity, investment goals, and risk capacity. You can either pay the minimum annualised premium or choose an amount up to the maximum annualised premium limit as per your choice.

10. Where can I check my policy fund value?

If you have a Unit Linked Insurance Plan (ULIP) with Tata AIA Life Insurance, you can check the fund value by logging in to My DigiAccount. Click here.

11. Where can I check the other funds of Tata AIA Life Insurance?

Follow below steps:

● Visit our Fund Fact sheet corner on Tata AIA website ● Select year and month to download the fund factsheet ● View details of all the funds along with their objective and performance

12. Where can I check the other funds of Tata AIA Life Insurance?

There are three main benefits of diversifying an investment portfolio:

● Firstly, with a diversified portfolio, your investment portfolio risk will not only be minimised but will also be able to withstand market volatility ● Secondly, not all investments and asset classes perform the same at any point in time. A combination of different investments will allow your investment to grow as per the performing asset classes and eliminate the need for constantly monitoring the portfolio ● Lastly, many investments grow on the principle of compound interest. When making a long-term investment with a diversified portfolio, all your investments can benefit from the power of compounding and enable optimal returns.

13. What does asset allocation mean?

As an investment strategy, asset allocation distributes the funds of a portfolio in different proportions into various asset classes. This is done to balance or maintain the risk profile of the investment.

Suppose an investment portfolio is being realigned as per an investor’s risk profile, investment goals and investment horizon. In that case, the asset allocation across different asset classes will be carried out to match the investor’s needs. Some may need to invest more in equities, while others may opt for greater asset allocation in debt instruments.

FOR EXISTING POLICY

FOR EXISTING POLICY  1860 266 9966

1860 266 9966

FOR NEW POLICY

FOR NEW POLICY