20-06-2022 |

A financial instrument offered by banks and Non-Banking Financial Corporations (NBFCs) fixed deposits are a type of savings account that offers more rate of interest for the money invested. They have a fixed tenure and predetermined fixed interest rates.

One of the cons of fixed deposits is that a regular FD does not offer tax* benefits, either on the money invested or on the returns earned. However, if you are looking at fixed deposits for tax-saving* purposes, then you should consider tax-saving fixed deposits.

In this article, we will take a closer look at tax-saving FDs and help you understand the meaning, features, benefits, workings and tax implications of these FDs.

What are Tax-Saving Fixed Deposits?

Tax-saving FDs are fixed deposit schemes that help you avail a deduction on your payable tax. Under Section 80C, you can avail a tax deduction equal to the amount invested in the tax-saving FD in the year of investment. The limit for tax deduction under Section 80C is ₹1,50,000. Thus, the maximum permissible investment under a tax-saving FD is ₹1,50,000.

Tax-saving fixed deposits have a lock-in tenure of 5 years. While the FD account can be either a single holder account or a joint holder account, the tax benefits can only be availed by the first holder of the joint account.

How does a Tax-Saving FD Work?

Let us understand the workings of a tax-saving fixed deposit with an example:

Ms Madhu invested ₹50,000 in a tax-saving FD in the year 2021 for a period of 5 years. She opened a joint FD account with her husband being the second holder.

Madhu being the first holder, only she can claim a tax deduction for the amount invested. She can claim a deduction of ₹50,000 under Section 80C of the Income Tax Act.

Considering she invested the money in 2021, she can claim the tax benefit for FY 2021-22 only.

The money invested is locked-in for the period of 5 years, i.e., the FD will mature in 2026. Madhu can opt to get the maturity amount directly transferred to her savings bank account. She cannot withdraw the amount prior to that.

In a tax-saving FD, only the amount invested is tax-deductible. The interest earned, just like a regular FD, is taxable.

Top Features of a Tax-Saving FD

- Tax benefits on the amount invested: Under Section 80C of the Income Tax Act, you can avail of tax deductions on the amount invested as per the prevailing tax norms and limits.

- Tax benefits can be availed in the year of investment: The tax benefits under Section 80C are only applicable in the year of investment and not for the entire tenure of the fixed deposit.

- Lock-in period of 5 years: The amount invested in a tax-saving FD is locked in for a period of 5 years. You can opt for a longer tenure, but the amount will be locked in for the first 5 years.

- Premature withdrawals not allowed: The account holder cannot withdraw the invested amount - partially or completely - before 5 years.

- Interest earned is taxable: The interest earned on a tax-saving fixed deposit is taxable under relevant tax norms and provisions.

- Cannot be auto-renewed: Tax-saving FDs do not have an auto-renewal feature. The maturity amount is either transferred to the linked savings bank account or paid to you as a demand draft.

- Fixed interest rates throughout the tenure: The tax-saving FD interest rates remain unchanged for the entire tenure of the tax-saving FDs. Any drop in the rate of interest will not affect your returns.

- Multiple modes of interest payouts: You can choose to get the applicable interest payout credited to your savings account on a monthly, quarterly or annual basis.

- No loan against the FD: You cannot avail of a loan against a tax-saving fixed deposit.

- Single as well as joint accounts: You can buy a tax-saving FD as a single account holder or with a second holder. However, only the primary holder can enjoy the tax benefits.

- Varied rates with different providers: The tax-saving FD interest rates will vary depending on the account holder and the bank. The rates for individual account holders are different from the rates for HUFs. Similarly, senior citizens get a higher interest rate.

Benefits of a Tax-Saving FD

- Low-risk secure returns: Tax-saving FDs are perfect for low-risk investors who are looking for guaranteed1 returns with no market fluctuations. The interest rates remain fixed throughout the FD tenure, ensuring a secure and assured return.

- If you have some unused amount in your savings account, it makes sense to save the money in a tax-saving FD and earn more interest with tax benefits.

- Lump-sum investment: As seen above, if you have a sizeable corpus in your savings account, you can invest the lump sum amount in a tax-saving fixed deposit. You can use this FD to invest any lump-sum amounts, such as a Diwali bonus or even retirement benefits.

- Wide range of deposit amounts: You can choose to invest any amount - from ₹100 to ₹1,50,000 - in a tax-saving FD based on your financial and tax-saving goals.

- Minimal lock-in: Tax-saving fixed deposits offer a basic lock-in period of just 5 years, making them great for mid-term savings.

Who can Invest in a Tax-Saving Fixed Deposit?

The following are eligible for investing in a tax-saving FD:

- Individuals (Indian citizens)

- Hindu Undivided Family (HUF)

- Minors (Compulsory joint account with a parent/guardian)

Documents Required to Invest in Tax-Savings Fixed Deposit

You need the following documents to open a tax-saving FD in a bank or an NBFC:

- PAN Card (for taxation purposes)

- Identity Proof (Aadhar Card, PAN Card, Driving Licence, Voter’s ID or any other government-recognised ID proof)

- Address Proof (Aadhar Card, Ration Card, Passport, Voter’s ID or any other government-recognised address proof)

- Proof of age (compulsory for senior citizens as they get a higher rate of interest)

- 2 recent colour passport-size photographs (in some institutions)

You may not have to provide these documents if you have an existing, KYC-compliant savings account or fixed deposits with the bank. Check with your bank/NBFC for the list of applicable documents.

Tax on Fixed Deposits

In a tax-saving FD, you enjoy tax benefits in the form of deductions in the total payable tax under Section 80C. However, the interest you earn (not the total maturity amount but just the interest) is taxable. Let us know the prevailing rules regarding tax on fixed deposits - regular as well as tax-saving.

- Tax is applicable on the interest earned if the total tax earned by the individual exceeds ₹10,000 in a financial year.

- Note that the calculation of the ₹10,000 limit is done at a per branch level of a bank. For instance, consider you have fixed deposits at 4 different branches of different banks and the total interest earnings exceed ₹10,000. You will only be taxed if the interest earnings exceed ₹10,000 in one branch. If not, you will not be taxed.

- The tax is charged Tax Deducted at Source (TDS) at the time of the interest payment.

- The TDS is charged at 10% in case the total interest exceeds ₹10,000. (The tax rate is 20% if the taxpayer does not have a PAN Card.)

- The TDS applied on your FD becomes part of your total tax liability for the given financial year. If your total tax liability is more than the TDS, you will have to pay the balance amount when filing your taxes. However, if the total TDS deducted on your fixed deposit is more than your total tax liability, you will have to file for a refund.

- The government has introduced two forms - Form 15H for non-senior citizens and Form 15G for senior citizens to help them file for a TDS refund. These declaration forms allow individuals, whose tax liability is zero, to inform the bank of the same and get a refund of any TDS charged by the bank. Fresh declaration forms have to be submitted for each financial year.

Secure Your and Your Family’s Future with a Life Cover

Fixed deposits, especially tax-saving fixed deposits, are perfect to earn low-risk assured returns on your investment plan. You can ensure separate FD accounts for each of your and your family’s financial goals.

However, life is unpredictable and you need to ensure that in case of your demise, the family does not burn through the savings. A life insurance policy allows you to provide for your family, over and above the various savings and avenues you have already created.

A life insurance policy will pay a predetermined amount to your loved ones upon your unfortunate demise. This ensures that they have an additional amount to take care of the financial requirements and pay off any outstanding debts. They will not have to rely on the carefully accumulated savings and can use them for their future requirements.

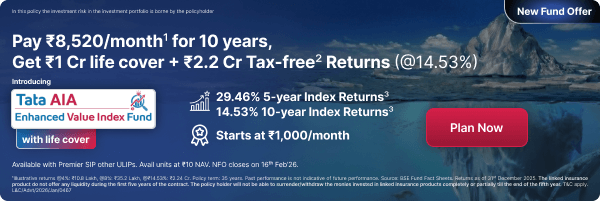

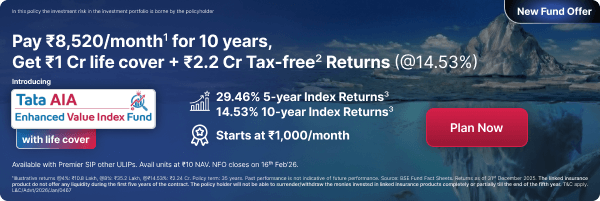

At Tata AIA, we offer a wide range of life insurance policies, including term plans, savings solutions, ULIPs, retirement solutions, etc. to help you find the life cover of your choice. You can also use our wide range of online calculators to find the best Tata AIA life insurance policy that matches your budget, financial targets and insurance goals.

L&C/Advt/2022/Jun/1212

FOR EXISTING POLICY

FOR EXISTING POLICY

FOR NEW POLICY

FOR NEW POLICY