19-07-2022 |

Old age requires a regular source of income to meet several expenses. You cannot earn for a lifetime, so investing in a retirement corpus when you are working is necessary. But the poor sections of society do not have the privilege of saving enough for their old age.

Thus, the government of India has introduced several pension schemes to help the poor save regularly for the post-retirement period. One of them is the Atal Pension Yojana, specifically designed for informal sector workers.

The unorganised sector in India contributes around 50 per cent of the Gross Domestic Product, employing 80 per cent of the country’s workforce. To socially secure such a large workforce, the government launched the Atal Pension Yojana scheme in 2015. The scheme aims to provide old-age security benefits to the informal workforce. Read ahead to know about the Atal Pension Yojana details and how it works.

About Atal Pension Yojana

The Atal Pension Yojana is a pension scheme in India which replaced the erstwhile Swavalamban Yojana. By encouraging early savings, the scheme helps reduce the financial burden of the underprivileged sections of the country. With several monthly subscription options, a subscriber can invest in the retirement corpus according to their pocket.

Atal Pension Yojana Eligibility

Any Indian citizen of 18 years of age is eligible to join the scheme, and the Atal Pension Yojana age limit is 40 years.

The scheme is open to all bank account holders.

The individual must furnish proof of possession of the Aadhaar or enrol for Aadhaar authentication.

Features of the APY

The APY scheme details are as follows:

The scheme is regulated by the Pension Fund Regulatory and Development Authority.

An individual enrolled in the scheme is eligible to receive a pension of ₹1000-5000 per month upon reaching the age of 60 years. The pension amount depends on the contributions made.

The subscriber’s spouse is also eligible for the pension after the subscriber’s demise. If both the subscriber and spouse pass away, the pension fund is given to the nominee.

The Central Government also contributes 50 per cent of the total contribution or ₹1000 per year, whichever is less for the beginning five years of the scheme launch. This benefit is for subscribers joining the scheme before 31st December 2015. Also, the individual should neither be a member of any other social security scheme nor a taxpayer*.

The subscriber can change the amount of contribution once in a financial year.

Under the scheme, you can connect your bank account with the Atal Pension Scheme account for automatic deduction.

The scheme uses the Institutional Architecture of the National Pension System for enrolling subscribers.

How Can You Apply for APY?

To enrol for the scheme, you can visit any nationalised bank in India and follow the steps below:

Download the application form from the website of Atal Pension Yojana online or visit a nationalised bank to fill out the form.

You must have a self-attested photocopy of your Aadhaar along with the original copy for verification.

After submission of the application form and the KYC document, you can choose from the payment options.

You will get a confirmation SMS once your application is approved. After this, you will be successfully enrolled under the Atal Pension Yojana.

Penalty for Late Payment

If you do not pay the contributions of the APY scheme on time, you may have to pay penalty charges. They are as follows:

Monthly contribution (in rupees) |

Penalty charges |

₹100 |

₹1 |

₹101-500 |

₹2 |

₹501-1000 |

₹5 |

₹1001 and above |

₹10 |

If you default on the payments for six months, your account will be frozen. While the account gets terminated if there is a payment default for twelve months. But the contributions and the interest are given to the subscriber.

Atal Pension Yojana Benefits

The APY benefits make it an attractive scheme for individuals who wish to save for retirement. The several advantages of the scheme are as follows:

Atal Pension Yojana retirement benefit: With regular contributions in your working years, you get a monthly pension after retirement. The pension payments vary from ₹1000/2000/3000/4000/5000.

Atal Pension Yojana death benefit: The pension scheme continues even after the death of the subscriber. The spouse is the default nominee who can either choose to continue with the scheme or withdraw the corpus amount.

Secure investment backed by the government: The scheme promises guaranteed1 returns with no risks. Also, your investment amount is safe as it is backed by the government of India.

Tax* benefits: The contributions made under Atal Pension Yojana India are eligible for tax* deductions under Section 80CCD of the Income Tax Act. The highest tax* deduction is 10 per cent of the subscriber’s total income up to ₹1,50,000. Moreover, the APY scheme involves an extra tax* deduction of ₹50, 000.

Withdrawal of Pension

The beneficiary of the scheme can withdraw the pension amount in the form of an annuity payment once the scheme ends. Also, the individual can exit the scheme before reaching the age of 60 only in case of critical illness, diagnosis or death. The spouse is eligible to continue with the scheme or withdraw the funds if the subscriber passes away. However, if the subscriber withdraws the pension amount before the age of 60, only the accumulated fund and the interest is paid.

Conclusion

A pension plan acts as a saviour in old age when you stop earning. With a regular source of income, you can spend the golden years of your life without worrying about finances. So, you must invest in a retirement plan at the right time to spend your old age happily. You can also invest in life insurance plans to build a retirement corpus along with a life cover.

Tata AIA life insurance plans give you the perfect investment solutions. With regular premiums, you can ensure your family’s financial security in case of an eventuality. Also, with tailor-made options, you can invest for a life cover, pension and creation of wealth. So, don’t delay and buy the right insurance plan for yourself and your loved ones.

L&C/Advt/2022/Jul/1573

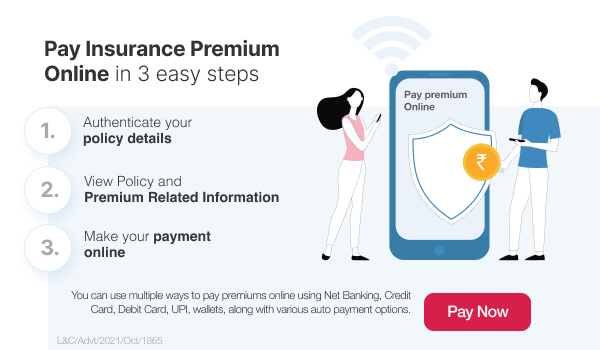

FOR EXISTING POLICY

FOR EXISTING POLICY

FOR NEW POLICY

FOR NEW POLICY