A simple guide to understanding Term Life Insurance

According to IRDAI, only 2.8% of Indians have life insurance coverage1. This suggests that most people in India might not get sufficient financial protection, with a number of people unaware of how term insurance works and why it is an important form of protection. If your family depends on your monthly income, securing their financial future with the right protection plan becomes important. A term life insurance is an easy and reasonably priced way to ensure your family stays financially secure even when you are no longer around. This article explains what term insurance is and how it works.

What is term life insurance policy?

A term insurance policy is a simple form of life insurance that offers financial protection for a specific term. During this term, individuals pay regular premiums. If the policyholder undergoes an unfortunate demise during the policy period, a death benefit is paid to the nominated beneficiary.

What is Policy Term?

Policy Term is the specific period during which your life insurance coverage is active. If the insured person passes away within this tenure, the insurer pays the death benefit to the nominee. The term length is chosen based on your financial needs.

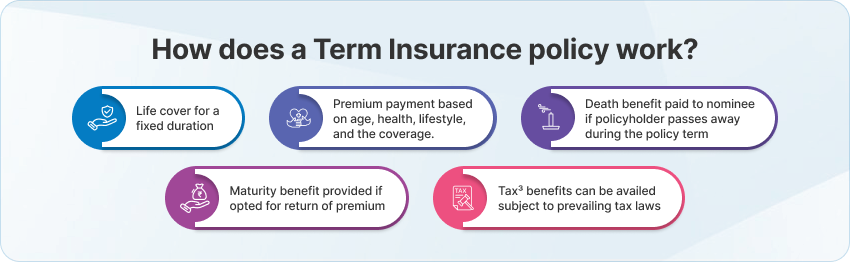

How does a term life insurance policy work?

The working of a Term Life insurance policy includes two basic steps. The first being policyholders paying regular premiums and the second being the beneficiaries receiving the assured sum as financial protection in case of the policyholder’s unfortunate demise during the term. Let us understand them in detail.

Individual chooses a policy

Individual reviews the policy, fills out the application, selects the coverage period, sum assured and undergoes medical tests, as required by the insurer.

Insurer decides the premium

Insurer evaluates the policyholder’s risk based on age, health, lifestyle and habits like smoking and determines the premium amount.

Premium payment starts

Once the policy is approved, the policyholder needs to pay the premiums - monthly, quarterly, half-yearly or annually, as per their convenience. The policy remains active as long as the premiums are paid.

Coverage period begins

From day one of the policy term, you’re covered. If you pass away during this period, the insurer pays the full sum assured to your nominee, as per the policy.

Get back premium on policy survival

You can opt for a term plan with return of premium2 to get back all your premiums paid if you outlive the policy term.

How to buy a term insurance policy?

After understanding what is term insurance, let’s go through the steps to buy it:

Step 1: Understand the policy

A term life insurance policy is an agreement between you and the insurance company wherein you pay a fixed amount, called premium, for a fixed period of time. The person to be covered under the policy is called 'life assured'. If the 'life assured' dies within that duration, the insurer pays money to the nominee.

Step 2: Fill the proposal form

You will need to provide the necessary personal and financial information while applying, which includes:

- Medical history and current health status

- Lifestyle habits (smoking, alcohol consumption, etc.)

- Age and income

- Profession

These details will help an insurer assess the risk and calculate your premium. Factors that can increase your premium include older age, smoking, high-risk hobbies, or chronic illness. A medical test may also be conducted if deemed necessary by the insurer. It may be tele-medical, video medical, or physical medicals.

Step 3: Decide policy details

You have to make a few key decisions before buying the policy:

- Life cover amount: The sum assured must be sufficient to cover the various expenses, debt repayment, and other future obligations of your family.

- Policy term: Choose for how long you want the coverage, such as until your children are financially independent or until your retirement.

- Premium payment mode: You can pay once, regularly over the term, or over a limited period.

- Payout option: You could then opt for a one-time payout or staged payments, whichever works for your family.

- Add-on riders4: At a small extra cost, you can add benefits in the form of accidental death or critical illness cover.

Step 4: Reviewing the premium quote

Once you fill out the form, the insurer will assess your details and give a premium quotation. If you agree and make the payment, your policy is considered activated.

Step 5: Manage changing needs

Certain term plans allow increasing cover over time. For example, one may be able to add more cover after marriage or the birth of a child or with an increase in financial responsibilities. This helps your policy keep pace with inflation and life changes.

Step 6: Appoint a nominee

You need to nominate someone, usually a close family member, who would get the policy benefits in case you pass away during the policy term.

What types of term insurance plans are available in India?

Term insurance plans available in India cater to a wide variety of financial needs with regard to the coverage and premium payables. The common types of term insurance plans are:

Level-term insurance

In level-term insurance plan, the sum assured remains fixed during the entire term of the policy. These plans have fixed premiums that give the policyholder predictable payments. This type of plan may be preferable for those who seek stability and consistency in financial protection for their family during the entire duration of the policy.

Decreasing term insurance

The sum assured in decreasing term insurance decreases gradually over a period of time. It can be chosen for those liabilities that decrease every year, like loans or mortgages. This plan ensures adequate coverage while keeping premiums low and in line with reducing financial obligations.

Increasing term insurance

In increasing term insurance, the sum assured increases periodically during the term of policy. It helps policyholders keep pace with inflation and ensures adequate protection over time. Such a policy may work for individuals whose dependent needs or lifestyle costs are expected to increase in future.

Who should consider buying term insurance?

Term insurance is an integral financial tool for those who want to save their loved ones from financial uncertainty. Here are a few types of individuals who can definitely benefit from a term plan:

Young professionals at the beginning of their career

Young individuals can lock in the price early in their lives for affordability and ensure financial protection in the future as responsibilities rise.

Primary income earners of a family

Individuals who are supporting dependents can secure their family’s lifestyle and future expenses through an adequate life cover at minimal cost.

Parents with dependent children

Parents can ensure their children’s education, upbringing, and aspirations remain unaffected, even in case of an unforeseen event.

Individuals with outstanding loans or liabilities

A term plan helps prevent debts such as home or personal loans from becoming a burden on family members.

People seeking tax benefits with life protection

Besides financial security, policyholders can claim tax3 deductions under relevant sections of the Income Tax Act.

Useful features of Term Insurance Plans

Term insurance plans come with several practical features that make them a smart financial choice.

Lower premiums

Term insurance offers high coverage at affordable premiums. Since this cover only the risk of death and doesn’t include any investment component, it is one of the most cost-effective methods to secure your family's financial future.

Flexible policy terms

The tenure of the policy can be selected depending upon your financial liabilities, such as till your children become financially independent or till your retirement. It is flexible to help you align it with your life goals.

Customisation Options

Term insurance plans offer flexibility to suit individual needs. You may choose from various policy terms, premium payment modes, payout options, and add-on riders3 based on your financial goals.

Advantages of Term Insurance

Here are some key benefits of term insurance:

Affordable premiums with high coverage

Term insurance provides life coverage for a fixed period at an affordable cost. It offers a large sum assured that may help replace several years of lost income.

Support in case of disability

Some term insurance plans include disability benefits. If you become totally and permanently disabled due to an accident during the policy term, the insurer will pay your remaining premiums.

Protection against critical illnesses

Certain plans offer additional coverage for critical illnesses. If you are diagnosed with a covered serious illness during the policy term, the insurer will pay a lump sum to help with treatment costs.

What happens at maturity?

Traditional term plans do not offer any maturity benefits. This means if the policyholder survives the term, no amount is paid out. However, you may choose policies with Term plans with Return of Premium (TROP2) or add it as a rider4 to obtain a maturity benefit. With these plans, if the policyholder survives the policy tenure, the insurer returns the total premiums paid.

Term Insurance plans from Tata AIA

Tata AIA Life Insurance has an Individual Death Claim Settlement Ratio (CSR) of 99.14% for the financial year 2024-25. This reflects the company’s commitment to timely claim settlements when your family needs it most.

Tata AIA offers the following term plans:

Tata AIA Maha Raksha Supreme

- Includes an accelerated payout benefit that provides 50% of the base life cover in case of terminal illness.

- Allows you to increase coverage as your insurance needs change, without requiring new medical tests.

- Life cover starts from ₹2 Crore

- Tata AIA Maha Raksha Supreme Select - Non-Linked, Non-Participating, Pure Risk, Individual Life Insurance Product (UIN: 110N171V12)

Tata AIA Sampoorna Raksha Promise

- Offers financial protection for your family with flexible premium payment options.

- Policyholders can choose to receive their death benefit as a lump sum or in instalments

- Life cover starts from ₹50 Lakh

- Tata AIA Sampoorna Raksha Promise - Non-Linked, Non-Participating, Pure Risk, Individual Life Insurance Product (UIN:110N176V07)

Tata AIA Saral Jeevan Bima

- Get comprehensive cover for your family

- Tax3 benefits on premiums paid

- The complete name of Tata AIA Saral Jeevan Bima is Tata AIA Life Insurance Saral Jeevan Bima - A Non-Linked Non-Participating Individual Pure Risk Premium Life Insurance Plan (UIN: 110N157V02)

Tata AIA Bharat Suraksha Cover Micro Insurance

- Simple and affordable protection plan

- Flexibility to choose your Policy Term and Premium Payment Term

- Tata AIA Bharat Suraksha Cover Micro Insurance Plan - Non-linked, Non-Participating Individual Micro Term Insurance Plan (UIN: 110N169V01)

Conclusion

Buying term life insurance is something everybody should do to ensure the financial security of their family. In case of the sudden demise of the policyholder during the term of the insurance, the nominee gets a guaranteed payout, providing stability to your loved ones. However, before buying term insurance, you should know how they work, compare a number of plans with each other, and then align features, conditions, and exclusions with your needs. You can give long-term financial security to your family by choosing a policy that aligns with your family’s needs.

FAQs on how Term Insurance works

-

1. How does a term insurance policy work?

You pay regular premiums for a fixed period, and if you die during the policy term, the insurer pays a sum to your nominee.

-

2. What does a term insurance policy cover?

It covers the risk of death during the policy term, providing financial support to your nominee in case of your demise.

-

3. How is the premium of term insurance calculated?

Premiums are calculated based on factors such as your age, health, lifestyle, coverage amount, and the duration of your policy.

-

4. What if I die during the term of the policy?

The insurer pays the agreed sum assured to your nominee to help cover financial needs.

-

5. How is term insurance different from other life insurance plans?

Term insurance provides life cover for a fixed period at low premiums. Life insurance policies, on the other hand, come with savings or investment elements in addition to the life protection component.

-

6. What happens if I outlive my term plan?

If you outlive the policy term, the coverage ends, and no payout is made unless you have opted for a return of premium option.

-

7. Do I get any money back after my term life insurance ends?

Generally, term life insurance does not have any maturity benefit. You get a payout only if you have opted for return of premium option.

-

8. Can a term life insurance policy be surrendered?

It cannot be surrendered for a cash value since term insurance is for life protection only, with no investment component involved in it.

-

9. What happens once my 20-year term life insurance policy expires?

When the term ends, the life coverage stops, and no benefits are paid. However, you may have the option to renew your policy.

-

Disclaimer

- 1Source:

https://m.economictimes.com/industry/banking/finance/insure/indias-insurance-penetration-declines-for-second-consecutive-fiscal-year/articleshow/116649538.cms#:~:text=The%20Insurance%20Regulatory%20and%20Development,82.52%25%20in%20FY24:%20Irdai%20report - 2Under Life Promise Plus Option, an amount equal to the 100% of the Total Premiums Paid (excluding loading for modal premiums) shall be payable at the end of the Policy Term, provided the life assured survives till maturity and the policy is not terminated earlier.

- 3Income Tax benefits would be available as per the prevailing income tax laws, subject to fulfilment of conditions stipulated therein. Income Tax laws are subject to change from time to time. Tata AIA Life Insurance Company Ltd. does not assume responsibility on tax implication mentioned anywhere in this document. Please consult your own tax consultant to know the tax benefits available to you.

- No Goods and Service Tax shall be applicable on Individual life insurance products as per prevailing laws. Tax laws are subject to amendments from time to time. If any imposition (tax or otherwise) is levied by any statutory or administrative body under the Policy, Tata AIA Life Insurance Company Limited reserves the right to claim the same from the Policyholder.

- 4Rider is not mandatory and is available for a nominal extra cost. For more details on benefits, premiums, and exclusions under the Rider, please contact Tata AIA Life's Insurance Advisor/ branch.

- This product is underwritten by Tata AIA Life Insurance Company Ltd.

- Insurance cover is available under this product.

- In case of non-standard lives, extra premiums will be charged as per our underwriting guidelines.

- This plan is not a guaranteed issuance plan, and it will be subject to Company’s underwriting and acceptance.

- For more details on risk factors, terms and conditions please read Sales Brochure carefully before concluding a sale.

- Premium will vary depending on the option chosen.

- Buying a Life Insurance Policy is a long-term commitment. An early termination of the Policy usually involves high costs, and the Surrender Value payable may be less than the all the Premiums Paid.

- L&C/Advt/2025/Sep/3295

- 1Source:

FOR EXISTING POLICY

FOR EXISTING POLICY

FOR NEW POLICY

FOR NEW POLICY